As 2013 began, political battles over the budget raged in Washington generating fears the U.S. economy could dive off the “fiscal cliff.” The economy was staggering at sub 2% GDP growth and stocks were mostly range bound over the prior year. Globally, the European economy remained in a lengthy recession while Latin American and even Asian business activity limped along in slower growth mode. With these concerns as a backdrop it’s not surprising most financial professionals did not expect big things for stocks in 2013—most certainly not the +26% gains for the bellwether Dow Jones Industrial Index. Indeed at Pring Turner we were optimistic for stocks saying in last year’s market outlook “the bull market for stocks that began in March 2009 will likely continue to move higher into its fourth year.” But quite honestly we were surprised by the extraordinary gains for U.S. stocks, almost without interruption, that persisted throughout the year. Investors brushed aside all risk. In hindsight, we invested too cautiously in 2013—when we err it is on the cautious side with our conservative business cycle investment philosophy.

Not as surprising to us was the poor performance of most fixed income investments last year. Indeed bonds suffered their worst year since 1994 as interest rates started to move higher. Pring Turner purposefully underweighted longer term bonds and instead favored high yield, shorter-term and floating rate bank loan funds which turned out to be the better performing segments of the fixed income market. Another major asset class we underweighted were REITS (real estate investment trusts), which partly due to their sensitivity to interest rates also dramatically underperformed most stock market sectors. Finally, yet one more important asset class, commodities and natural resource sectors of the stock market were also relatively weak, a particularly confounding result since global growth stepped slowly higher as the year progressed. Gold’s poor performance was especially disappointing to us considering our proprietary inflation barometer signaling inflationary pressures were building.

In sum, for 2013 the performance of diversified portfolios that included all major asset classes paled in comparison to the strong gains of U.S. stocks. The big surprise for all investors was the fact those gains were made despite sluggish, not quite 2% economic growth rate that translated into less than 6% earnings growth for companies during the year. The question for investors now is: How much good news is already reflected in stock prices and has the stock market gotten too far ahead of the economy?

What’s Next in 2014?

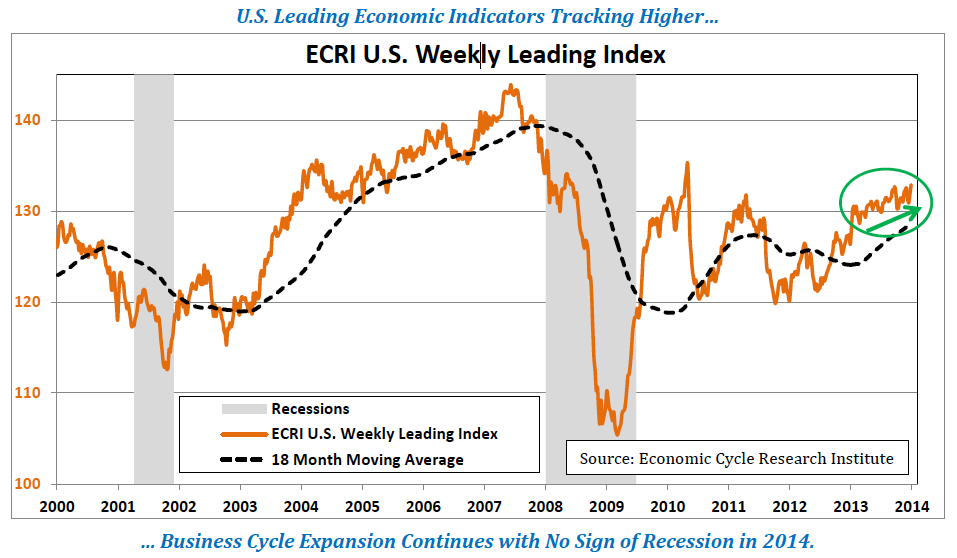

Economy: This year begins quite a mirror image from last with investment professionals and individual investors alike feeling much more confident. Economic headlines are certainly more optimistic compared to the early days of last year. Employment is slowly recovering, budget deficits are shrinking, residential real estate prices are stronger and U.S. manufacturing is making a comeback. The end result of this improving news is consumer confidence has climbed to post-Great Recession highs. Adding to the list and most important from our business cycle perspective, is the fact leading economic indicators for the U.S. economy continue to track higher levels indicating there is no sign of recession in 2014.

Better yet, on balance the forward looking economic indicators from major economies around the world point to further growth in the year ahead. For the first time in years global economies may be expanding in synch with each other adding a further tailwind for our own economy. Those are just some of the positive economic factors entering 2014.

Stock Market: We do have a few concerns. One concern is the fact U.S. stocks have not experienced a 10% or more decline in more than 18 months—an unusually long period without a significant correction. Typically, there is at least one 10% decline each year. Corrections offer us opportunities to put money to work at better prices. This past year and a half without any deep corrections have not allowed for even one of those really attractive buying points—in other words, patience has not been rewarded this time. Many stocks are currently stretched to the upside and like a rubber band, if not allowed to occasionally release tension, could snap at any time and kick off a more serious decline.

Another fly in the ointment is excessive bullish investor sentiment of late. Surveys of both professional and individual investors indicate a very high level of optimism; in fact many are at levels not seen in decades. Historically, excessive optimism can be a contrarily negative signal for future stock prices and can at least temporarily derail the stock market train.

Bonds: Lastly, the Federal Reserve (Fed) recently announced the beginning of the long-awaited “taper” of their unprecedented Quantitative Easing (QE-I, II, III, etc.) programs. Will the bond markets react with a “taper tantrum” as the Fed begins to unwind the extremely loose monetary policy that has in our opinion helped sustain the almost five year bull market in bonds and stock market recovery? The financial market’s reaction to the reversal of these extraordinary monetary experiments could lead to investor uncertainty and more volatility for stock and bond prices.

Tactics for the Coming Year

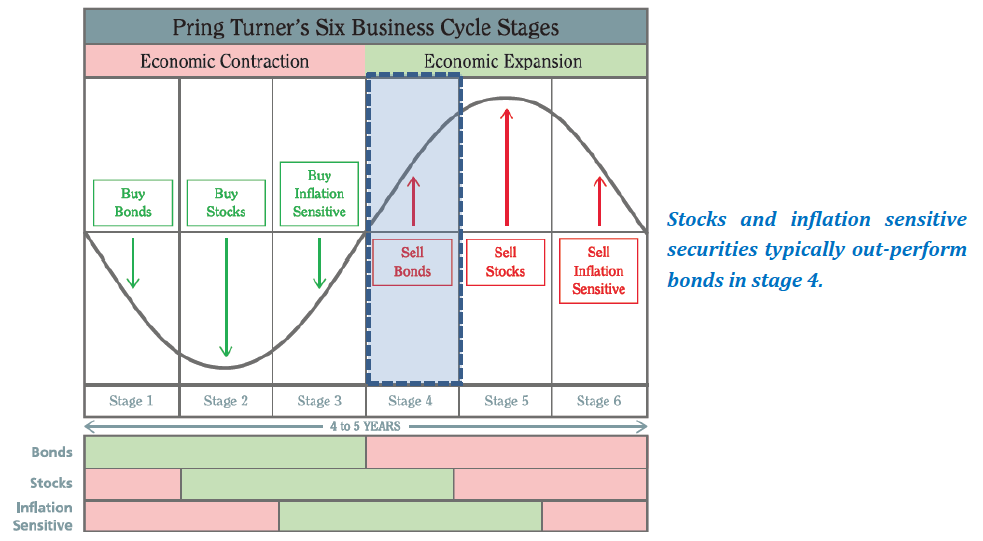

Bottom line the business cycle is progressing and picking up momentum that is supported by improving global economic activity. Our business cycle work continues to place us in Stage 4, an inflationary part of the cycle but price action in the financial markets has not totally reflected this so far. This phase of the cycle is characterized by four things—a growing economy, a rising stock market, a decline in bond prices and strength in industrial commodities. The current cycle has experienced the first three but so far industrial commodity prices have been range bound.

As 2014 begins we see evidence commodity prices are finally gaining traction and stand ready to join the party. We believe the next leg up to the secular bull market for commodities that began in 2001 is probably underway. The Pring Turner portfolio management team continues to monitor this evidence and seek opportunities to add new investments in emerging Stage 4 beneficiaries. Any market correction that leads to a change in market psychology would present an opportune time to deploy cash reserves and add these themes to the portfolio. With continuing economic strength in Stage 4, stocks remain the asset class of choice. As for bonds, our tactics will continue to underweight that asset class and focus on high yield, floating rate and short-term fixed income funds.

Our Purpose

Pring Turner’s dual mandate is to “protect and grow” wealth through both cyclic ups and downs. We have spent our entire careers studying market cycles and developed risk management tactics to grow wealth steadily and carefully. We firmly believe the key to success is to not lose big in the inevitable down years and to measurably participate in the good ones. Over a full 4-5 year market cycle and certainly over the last 37 years, Pring Turner has done just that—protecting and growing client’s valuable assets! We look forward to 2014 and are committed to raising our professional standards even higher in performance and service.

Thank you for your trust and confidence. Please let us know if you should have any questions or if your circumstances should change. Enjoy a happy, healthy and prosperous new year!

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.