As we start the New Year, we can honestly confess we don’t know exactly how 2015 will play out for investors. That statement is actually true at the beginning of each year, but in our years of experience we can say unequivocally some years are easier to anticipate trend changes than others. The way we see 2015 shaping up, there are two competing yet plausible scenarios—one positive and the other more problematic for investors.

On a favorable note, after almost six years of ragged and sluggish growth the economy could finally pick up enough steam to reach the long hoped for level of “escape velocity.” Escape velocity is the latest buzzword that simply describes the economy reaching a level of sustained growth without further need of extraordinary Federal Reserve stimulus (QE-quantitative easing). With The Fed having finished the “taper” of Quantitative Easing in late 2014, we will soon find out if the U.S. economy can sustain itself. At the same time the U.S. is winding down its QE program, Europe may be getting closer to ramping up its own version of QE. Any movement by Europe’s central bank to stimulate their weak economy would be welcome news for investors and would likely take global stock prices higher.

The second scenario, and in our opinion less likely possibility, is at some point later in the year the U.S. economy stalls out and joins much of the rest of the world like Europe, Japan and Latin America in a global slowdown. A stalled U.S. economy would certainly change investor expectations and dampen current optimistic sentiment. Clearly, each of these scenarios has differing outcomes for investors. Later in this newsletter we will update you on where our latest business cycle research weighs in. The good news is our time-tested business cycle research tools will alert us to significant changes in the current positive economic backdrop. The unique benefit of Pring Turner’s investment strategy is the flexibility to adapt your portfolio to a changing environment.

2014—Lessons Learned

Before we summarize our outlook for 2015, we do want to review the last year and update you on incremental advances to our investment process. At Pring Turner, we continually review our investment practices with the unending mission of improving our decision-making practices. While we acknowledge no investment strategy will ever be perfect, our core disciplines have for decades rewarded clients well by both protecting and growing their wealth. We do believe our flexible investment strategy with a solid foundation revolving around the normal and repeated swings of the business cycle is a powerful edge for investors. Last year started out very strongly for portfolios as our emphasis on inflation sensitive sectors helped portfolios outperform. For instance, overweighting the energy sector aided in pushing portfolios to new highs almost each month for the first two-thirds of the year. Energy led the way up but starting in September also led the way down as a vicious and abrupt decline in oil prices took hold. Simply stated, in the last third of 2014 we stayed too long with the inflation theme and were late to take action. This period of underperformance led us to thoroughly review our research models and investment process. The end result is we were able to make some improvements to our long term models (Barometers) and considerably tightened our selling disciplines. We anticipate the latter will meet our goal of moving more quickly to both limit losing positions and protect profitable ones.

We are confident these adjustments along with others will improve your results and build upon our strong long-term track record. Our over-riding goal remains the same as it has been since Pring Turner’s founding in 1977, deliver consistent and solid risk-adjusted returns for conservative investors.

2015—Continued Slow, Steady Growth Ahead

Let’s start with the U.S. economy and assess the potential of reaching the Fed’s long awaited “escape velocity.” The latest readings in the leading economic indicators continue to climb higher suggesting there is no imminent threat of recession for the economy. This business cycle expansion, even approaching a rather mature 6th birthday, still has reasonably clear skies ahead. Recent falling energy prices along with steady job growth are bolstering consumer confidence. These quite favorable conditions translate into even higher consumer spending levels, a key ingredient to sustaining economic growth.

And what does this economic backdrop mean for bonds and stocks? To answer that, first let’s review Pring Turner’s bond barometer, a tool designed to define favorable or unfavorable environments for bonds. Currently this barometer is still positive with a maximum positive reading of 100. U.S. Treasury bond prices have rallied strongly this past year likely due to two main reasons. First, foreign investors are actively seeking a safe haven from turmoil overseas and U.S. dollar based bonds are one choice. At the same time the U.S. budget deficit is contracting meaning the government has fewer bonds to sell. This combination of increased demand and lower supply continue to move Treasury bond prices higher. The strongly favorable barometer level extends the positive investment outlook for high quality bonds and other low interest rate beneficiaries such as dividend paying stocks in the utility, REIT (real estate investment trust) and financial sectors.

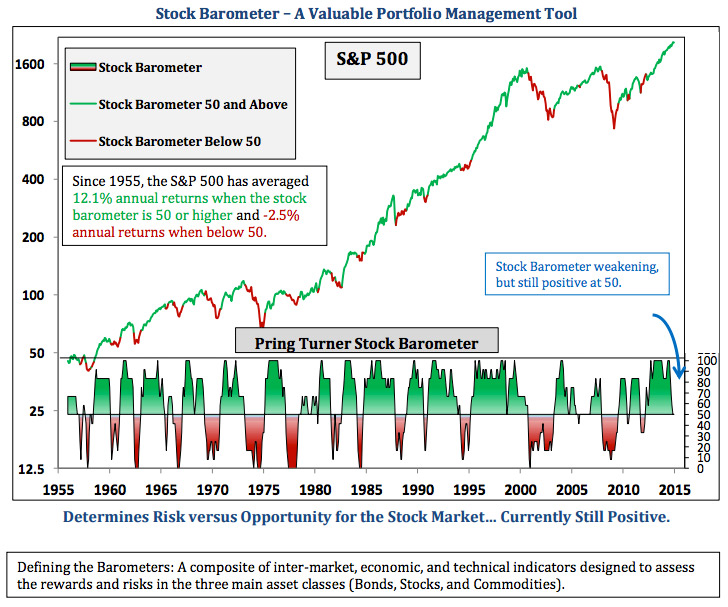

For the stock market, 2015 starts out with the continuation of the positives that have pushed this market higher the past few years: low interest rates, slow growing economy with steady earnings growth. Our stock barometer at the current 50 level (out of a maximum 100 reading) is still favorable, although not displaying as strong a reading as just a few months ago. This barometer defines both favorable and unfavorable environments for stocks. The principal function of the stock barometer is to signal us when to focus efforts on either diligently protecting wealth during bear markets or growing it during good periods. The chart shows the barometer captures the vast majority of the bull and bear market swings since the 1950’s. Although not perfect, the stock barometer has a credible long-term track record and we are on alert to either improvement or weakening in this important indicator.

The main advantage of Pring Turner’s barometers is to take emotions and guesswork out of the investment decision making process. As we move through a business cycle and our barometer work changes we stand ready to make strategic changes in an effort to both protect and grow your wealth. When the evidence changes we adapt portfolios accordingly.

Managing money can be a tough job, sometimes a humbling experience but still a most rewarding career to know we, in the long run, have been able to help our clients plan for retirement and live comfortably. Confident in our business cycle research along with recent improvements to our disciplines, we look forward to both meeting the challenges and taking advantage of the opportunities in 2015 and beyond.

We wish you all a happy, healthy and prosperous new year!

Click the following link to download the PDF version of the newsletter:

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.