Congratulations! Your investment portfolio generated strong gains with relatively low volatility throughout most of 2024. However, an unusually weak December puts a damper on things and raises concerns for the New Year. Naturally, after two solid years of market advances, the question we keep hearing is: how much longer can stocks continue going up? The short answer is that we believe this year has the potential for further gains, although they are likely to be more moderate.

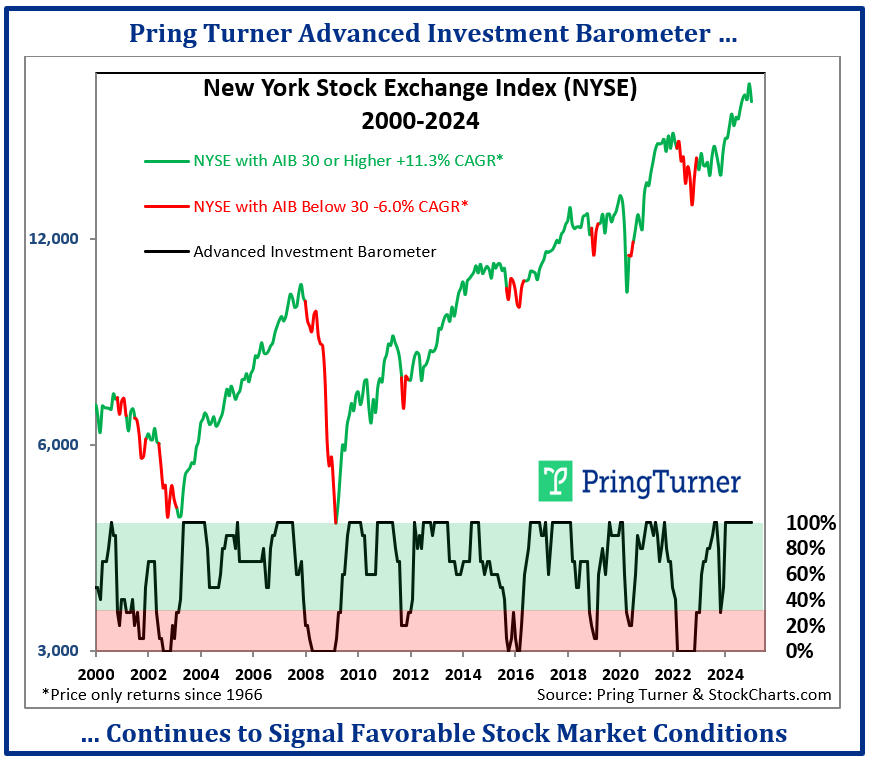

At the start of last year, we were confident in forecasting further upside for the cyclical bull market in stocks. Our January 2024 newsletter stated: “As we start the new year, our proprietary Advanced Investment Barometer™ remains in a positive mode, indicating further upside in the stock market.”

Our AIB™ Is constructed from a variety of momentum, trend following, and inter-asset relationships. The principal function of the barometer is to warn about major bear markets. As the chart depicts, although not perfect, the AIB™ has a credible long-term track record. Since 1966, when this stock market gauge is above 30, the average annual price only returns for the NYSE are +11.3%. When the gauge is below 30, average annual returns drop to -6%. This valuable tool helps us assess the overall risk vs. reward dynamics in the stock market. The goal is to effectively protect your wealth through challenging periods and grow it during favorable times. As long as the AIB™ remains comfortably in “growth” mode, we will maintain our optimistic market outlook.

New Administration, New Challenges, and Opportunities

This year begins with a range of new crosscurrents, some potentially favorable and others more concerning. Most likely, 2025 will bring a return to a more normal and challenging financial environment for investors. In our 2025 financial market outlook, we will explore both the challenges and opportunities that lie ahead.

Stock Positives—

- Earnings are projected to grow again this year, providing support for stock prices.

- Despite a sluggish manufacturing sector, overall economic growth continues.

- The Fed began easing short-term interest rates last fall, which should aid growth.

- Our Advanced Investment Barometer™ is still positive, but we remain alert to any changes.

Stock Negatives—

- High stock valuations, particularly in the tech sectors, could lead to more volatility.

- Despite the Fed’s easing moves, consumer interest rates, like mortgages, are higher.

- While inflation has improved, it continues to be a problem for consumers and businesses.

- Geopolitical turmoil around the world could negatively impact stock prices.

Bond Positives—

- Yields are attractive and offer higher rates than inflation, providing some competition for stocks.

- Bonds can diversify portfolios by appreciating when stock prices decline.

- Quality bonds provide reliable income streams, adding stability to investment portfolios.

Bond Negatives—

- A resurgence of inflation could lead to higher rates, which would reduce bond prices.

- Continued budget deficits could increase bond supply, pressuring prices.

- New trade policies could be inflationary, reducing bond attractiveness.

Overall, while both the stock and bond markets hold potential for gains, they also face uncertainties and considerable risks. Shifting economic, fiscal and monetary policies, inflationary pressures, and uneven global economic conditions will likely contribute to higher market volatility. In simple terms, while 2024 was a fairly smooth and profitable ride for investors, we expect 2025 will bring more uncertainty, along with pockets of opportunity.

Tactics for 2025

Steady economic growth and higher corporate earnings are expected to continue serving as tailwinds for stock prices. Your core stock holdings are strategically diversified across various economic sectors and share key attributes: high quality, solid value and above-average dividend income. It is important to remember you do not own ‘the market’; rather, you own a very select group of well-established companies. Our primary objective remains generating positive, inflation-adjusted returns while minimizing risk.

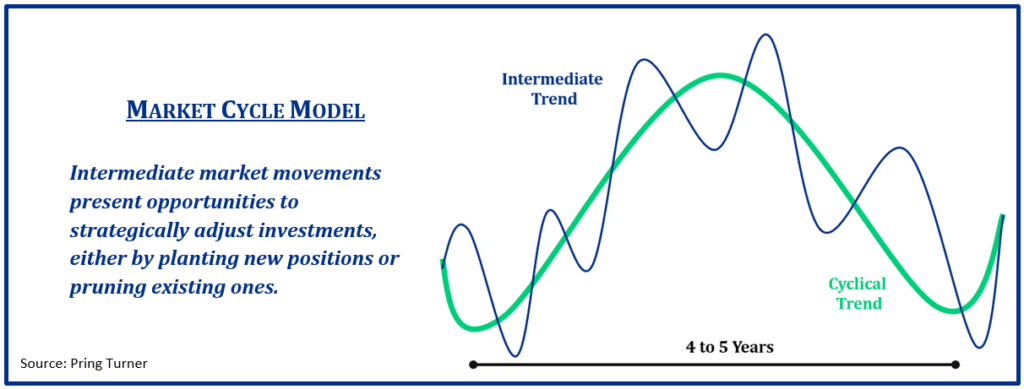

An additional risk management tactic involves closely monitoring intermediate market movements. These are shifts lasting two to six months that can take prices up or down by at least ten percent. The “market cycle model” illustrates these fluctuations through our familiar bell-shaped curve of the typical market cycle.

Certainly, the market does not move in a perfectly smooth manner, but the diagram serves as a useful illustration. Fluctuations above and below the major cyclical trend, known as intermediate moves, provide us with opportunities to strategically adjust investments—either by planting new positions or pruning existing ones—while remaining aligned with the cyclical market trend.

To evaluate risk versus opportunity over the intermediate term, we developed a model long ago called the “Fuel Tank.” This tool is designed to signal whether stock market trends over the next 2–6 months are likely to be favorable or unfavorable. Much like a fuel gauge in a car indicates whether you can embark on a long journey, the Fuel Tank serves as a gauge for the stock market’s potential. Recently, the Fuel Tank indicator has been filling up. While some zigzagging in the weeks ahead is expected, the rising fuel levels bolster our confidence that stock prices have the potential to ultimately move higher.

The fuel tank is filling up… … stock prices may ultimately move higher.

… stock prices may ultimately move higher.

While 2024 did not experience a typical 10% market decline, our sense is that we may very well experience at least one this year. A more volatile market will make the Fuel Tank especially useful as we navigate the year ahead. It is important to note that our Fuel Tank is just one of many tools we use to assess risk versus opportunity in the stock market. Typically, this model swings between full and empty several times a year, creating timely opportunities to make gradual adjustments to your investment portfolio. These measured portfolio shifts at key turning points are particularly valuable as we aim to smooth your investment journey.

Summary

Each New Year brings its own set of unique challenges and opportunities. Our role is to carefully navigate the paths to ensure you can benefit from market gains, while minimizing downside risk. That is made possible through the discipline, research, and experience we bring to every decision we make on your behalf.

After two consecutive years of above-average stock market performance, it is only reasonable to anticipate more moderate returns in 2025. However, with the Pring Turner AIB™ model remaining in growth mode and the Fuel Tank indicator refilling, we remain optimistic about the potential for further portfolio growth in the year ahead.

Thank you for entrusting us to support you in achieving your financial goals with peace of mind! We deeply value the patience, perseverance, and confidence you demonstrate in sticking to our conservative investment strategy through the market’s inevitable ups and downs. We remain committed to working diligently to earn your trust every day and look forward to another great year ahead.

Wishing You A Happy, Healthy and Prosperous New Year!