My reflections from the 2019 Berkshire Hathaway Annual Meeting

You would think that helping our client families with their financial plans and investment management would be enough to satisfy my investing obsession: wrong! As my wife (Genna) can fully attest, I am a true value investing nerd. Away from the office, my favorite passion is spending precious time with Genna and raising our young children (Kate, Charlotte, and Patrick). Being around my kids has taught me valuable life lessons about patience, humility, discipline and much more. My second passion is learning from a much older crowd. Warren Buffett (88) and Charlie Munger (95), two investing wizards and the leaders of the highly successful enterprise known as Berkshire Hathaway have been great role models that I observe and learn from.

It has been more than eleven years since I first discovered the writings of Warren Buffett and some of his value investing brethren John Templeton, Philip Fisher, and Peter Lynch. Their long-term, value-driven investment style resonated with me immediately, a style that is one of the cornerstones of the investment process we utilize at Pring Turner. After analyzing Buffett’s extraordinary investment track record, I became a true believer. So, how good is his track record? Since he assumed control of Berkshire Hathaway in 1964, the stock has earned roughly 21% per year for the last 54 years! Simply incredible! To put that in dollar terms- a $10 initial investment in Berkshire 54 years ago would be worth over $320,000 today! Had that money been invested in an S&P 500 index fund instead, it would be worth less than $2,000. That’s not a typo. Warren has outperformed the market by over 160 times!

Suffice to say that one item on my bucket list was to attend the Berkshire Hathaway Annual Meeting in Omaha, Nebraska. This May, Pring Turner sent me to my first meeting and I want to share my story of the extravaganza.

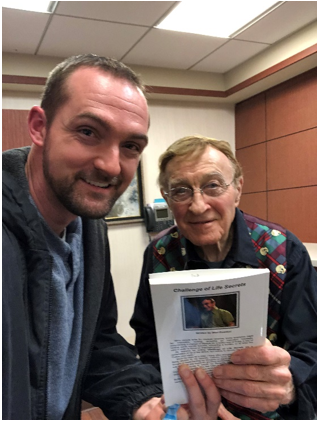

When I initially landed in Omaha for the “Woodstock of Capitalism”, I had not met any of the additional 40,000+ people in attendance. However, I found it very easy to make friends as everyone I encountered was so kind. One of the most genuine people I met on the trip was Stan Dosekal (pictured). Stan is an Omaha native that runs the two-chair barber shop in the basement of Kiewit Plaza, the location of Berkshire Hathaway’s corporate headquarters. Stan has two claims to fame: 1) he is in excellent physical shape (he can do 100 chin-ups at the age of 80!), and 2) he has been cutting Warren Buffett’s hair for decades! In fact, while Stan was giving me a haircut around 5:00 pm on Friday afternoon, I saw Warren stroll by the barber shop on his way to the parking garage (good to see Warren is still putting in long hours at the office).

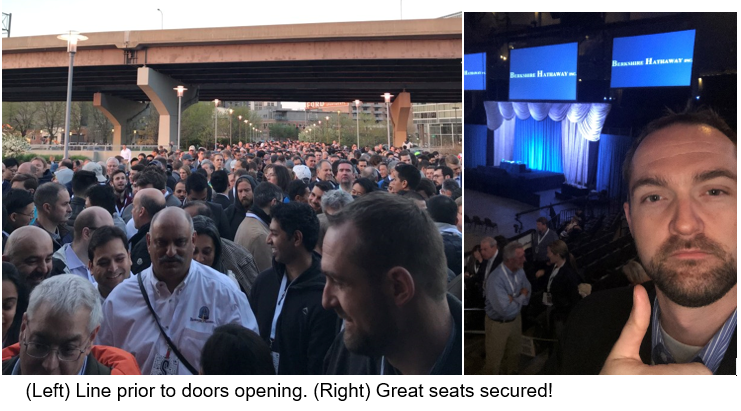

To further cement my investing nerd status, I arrived at the convention center at 3:30 am Saturday morning to wait in line (doors open at 7:00 am). I wanted to make sure I had a great seat for the day-long meeting. Needless to say, I had a great time. Here are five key investment takeaways from the meeting and Buffett’s investment philosophy that I found particularly enlightening.

Five Key Lessons

1) Consider yourself an owner of the companies (stocks) in which you invest. It’s easy to forget that a stock is more than a ticker symbol with a constantly changing price. It is really a partial ownership interest in a business. Whether you are buying 1 share or 10,000 shares, your decision process should remain the same. At Pring Turner, we focus on investing in only the highest quality companies with steady and superior earnings growth, because over the long run our investment performance will ultimately be determined by the company’s business results.

2) Give yourself a margin of safety when investing. Investing is simple but not easy. Even the best investors make mistakes. One way we can further protect ourselves is to purchase stocks at a price far below what we think its worth. This way if our business analysis proves incorrect, which it undoubtedly will be from time to time, we have an additional layer of protection or margin of safety. It’s like having a shock absorber for your investments. When the road gets bumpy you will be thankful you have this added layer of protection to cushion the ride.

3) Use market volatility as an opportunity. The constant ups and downs of the stock market terrify most investors. Instead of fearing them, take advantage. Warren Buffett has a terrific saying about investing: “Be fearful when others are greedy and greedy when others are fearful.” From time to time, stock market participants can become irrational, which provide excellent opportunities for long-term value investors like Pring Turner to purchase great companies at bargain prices.

4) Be a long-term investor in a short-term world. Whoever penned the phrase, “Patience is a virtue”, must have had investors in mind. Today, we are constantly bombarded with information and quick news that can make it extremely difficult to stay patient and stick to our long-term disciplines. Over the short-term, the stock market can be irrational and very unpredictable. However, over the long run, the odds suggest that stocks will continue to be the best performing asset class. It’s crucial to have confidence in your plan so that when the markets test you in the short run, you can withstand and stick to your investment strategy for the long-term gains.

5) Temperament is more important than intelligence. Losing money can be emotionally demoralizing. Financial studies demonstrate that the average investor earns less, in many cases much less, than mutual fund performance would suggest. Why? We tend to let our emotions drive our financial decision making. Emotionally, it feels far better to buy high and sell low. Unfortunately, good investing requires the precise opposite, buy low and sell high! Warren Buffett’s famous for saying, “success in investing doesn’t correlate with IQ once you’re above the level of 100. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.” In other words, your emotional temperament is far more important to investment success than your intellect.

As you can tell, I thoroughly enjoyed my weekend in Omaha, along with many like-minded investors from across the globe. The long trip and hours waiting in line, in the middle of the night, was well worth it! Oldtimers Warren and Charlie have much wisdom to learn from and incorporate into our own value investing investment strategy. Reinforcing these key investing disciplines will help me and the Pring Turner investment team make smarter decisions in the years ahead.

Disclosure: Pring Turner Capital Group clients and employees own Berkshire Hathaway stock.

Did you like this post? unCOMMON CENT$ is my email newsletter and I want to share it with you. It’s a collection of all the uncommon financial secrets I’ve learned recently. It’s the best way to keep up with all my new articles. Please sign up for this free newsletter below.