Stock and bond prices added to strong first quarter gains! The gains were briefly interrupted in May when stock prices corrected due, in part, to several troublesome headlines. Investor apprehension over ongoing trade battles, Federal Reserve interest rate policy, recession concerns and rising tensions in the Persian Gulf formed the proverbial “wall of worry”. However, once again, the financial markets showed impressive resilience by shaking off a host of negative factors and ultimately climbing “the wall of worry” to new record heights. Better yet, we expect economic growth will re-accelerate in the second half of the year and bring continued upside for your portfolio.

JUST ANOTHER MID-CYCLE SLOWDOWN

Talk of recession is abundant in the media. Some argue the fact the current economic expansion will reach a 10 year-strong, post-WWII record this month is reason enough to be fearful. Granted, as discussed in our January special report, there has been a softening in several economic data points (i.e. home and auto sales), but, in our view, the current environment merely represents just another mid-cycle slowdown rather than the early stages of a recession. Here are a few good reasons to stay optimistic and expect further portfolio gains.

- Employment trends remain strong with more job openings than applicants to fill them.

- Consumer spending makes up 2/3 of the economy and households are in great financial shape.

- The Federal Reserve is expected to begin cutting interest rates to support the economy. Indeed, mortgage and other lending rates have already fallen sharply.

- A trade agreement with China could develop further and relieve a major source of uncertainty.

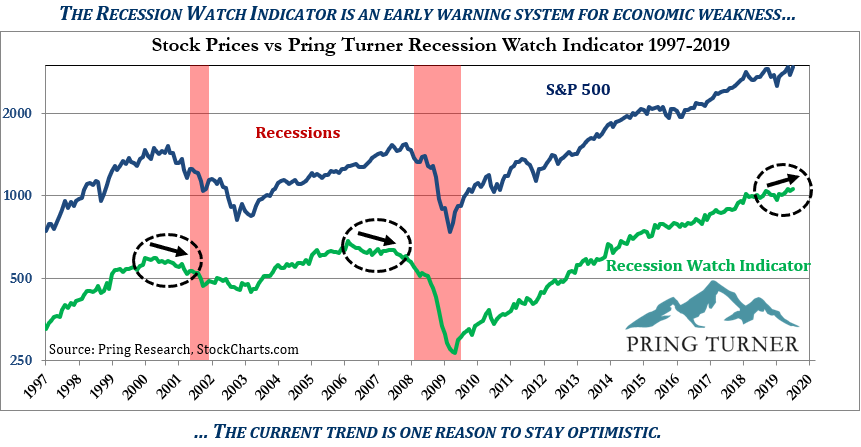

Finally, there is one more good reason to stay positive about the economy and markets. The Pring Turner Recession Watch Indicator (RWI) is still quite strong and signals that there is no recession in sight. The following chart shows the most recent 20-year history of this forward-looking indicator, and how it peaked out and began a persistent decline a year or more before the last two recessions. This behavior is in contrast with today’s positive trend where the indicator just reached an all-time high!

Recession Watch Indicator

The Recession Watch Indicator (RWI) is a leading indicator for the economy, designed to signal the onset of recession months in advance. The most severe stock market declines (-20% or more) have occurred during economic recessions. For retirees, it is especially critical to avoid recession-driven market declines in order to effectively secure a stable retirement lifestyle. Recovering from these big losses can be a difficult and highly stressful endeavor. This is one reason why we follow the natural rhythm of business cycle swings closely and stay on alert for major turning points in the economy. What is the RWI telling us now? The latest reading has pushed this leading economic indicator to new highs, signaling continued business expansion and that there is low risk of a recession in the coming months. Continued economic strength should translate into higher stock prices.

During the temporary market weakness in May, a few new high-quality stock positions were added to your portfolio with this positive economic backdrop in-mind. We are always on alert for compelling investment ideas that better position your portfolio with good value and dependable income. That said, the next portfolio tactic will likely be to lock in some bond profits, recognizing that interest rates have fallen and bond prices have appreciated considerably. Stronger economic growth would ultimately send interest rates higher and provide better bond buying opportunities later. In the meantime, if you need to refinance a mortgage, now could be the time to do it!

Summary

For now, we believe that the major trend for stocks is still up. There is likely no recession on the horizon that would alter our optimistic view for the economy and stock market, as evidenced by our Recession Watch Indicator. Our dual mandate is to “protect and grow” your wealth through both cyclic ups and downs. We have spent our entire careers studying market and business cycles to develop active risk management tactics that grow your wealth steadily and carefully.

Even though our outlook remains positive today, history teaches us that this can change. Rest assured, we will take steps to protect your wealth when financial conditions change and eventually deteriorate. We have long adhered to an “active” investment strategy. “Active” is best defined as meaning active risk-management. An active risk-managed approach emphasizes both a game plan for being offensive in the good periods and, most importantly, defensive during cyclical bear markets. Indeed, as the economic evidence changes, we will make portfolio changes with one overriding goal: to protect and grow your valuable assets through the entire business cycle. This dynamic approach has allowed you to steadily march to new high levels of wealth (adjusting for withdrawals) all while experiencing roughly half the stock market’s volatility.

Thank you for your trust and the opportunity to serve you and your family. Please let us know if you should have any questions or if your circumstances should change.

- Martin and Jim presented to the Silicon Valley chapter of the American Association of Individual Investors (AAII).

- Jim attended the Berkshire Hathaway Annual Shareholder Meeting in Omaha, Nebraska to learn from Warren Buffett. Click here to read about the key investment takeaways.

- Tom and Jim were invited back to speak to the $ums in Retirement Investment Group, a Sons in Retirement (SIR) sub-group located in Walnut Creek.

- Pring Turner became a proud partner with the Association of Financial Educators, a non-profit organization dedicated to empowering individuals to take control of their financial well-being.

We appreciate and welcome the opportunity to share our research, insights, and time with all kinds of investment and community groups!