This year marks Pring Turner’s 45th year of helping clients protect and grow their wealth. Over the decades, we have successfully helped our clients navigate through many bull and bear markets. A key lesson we learned along the way is that financial markets move from greed to fear and back again, and again, driven by the ups and downs of the always progressing business cycle. Successful investment outcomes depend upon a disciplined decision-making process that takes advantage of ever-changing financial market swings. When you add high-quality, income-producing companies at the right price to that mix, you increase the odds of a successful investment experience. Following this patient, pro-active, and proven process has helped us protect and grow your valuable assets for the past 45+ years. You can watch the entire 80-Minute event by clicking the play button above or keep reading below for the executive summary.

Welcome Aboard, Katie Fisher!

In July 2022, we introduced Katie Fisher as our newest team member! Katie is now our Operations Director and your go-to expert for all client service needs. She joins us with 17 years of outstanding industry and leadership experience. Most especially, she is a life rockstar. Katie was a scuba diver instructor in the Cayman Islands, is a certified skydiver, has ran 100-mile trail races, and has endless other stories and talents. We encourage you to contact Katie with your great questions, client service needs, and even to simply say hello, at (925) 287 – 8527.

Your Security is Our Priority!

Here are five key reminders and action steps that we can take together to better ensure your online privacy and security with us. Thank you for helping us serve you better every day!

(1) Never include sensitive information over email (i.e. full account numbers),

(2) Notify Pring Turner and/or Charles Schwab of any suspicious emails from either of them,

(3) Share your documents securely with us via the Pring Turner Vault (Black Diamond),

(4) Use Schwab’s DocuSign solution to eSign your Schwab paperwork, and

(5) We will require verbal authorizations for all move money requests.

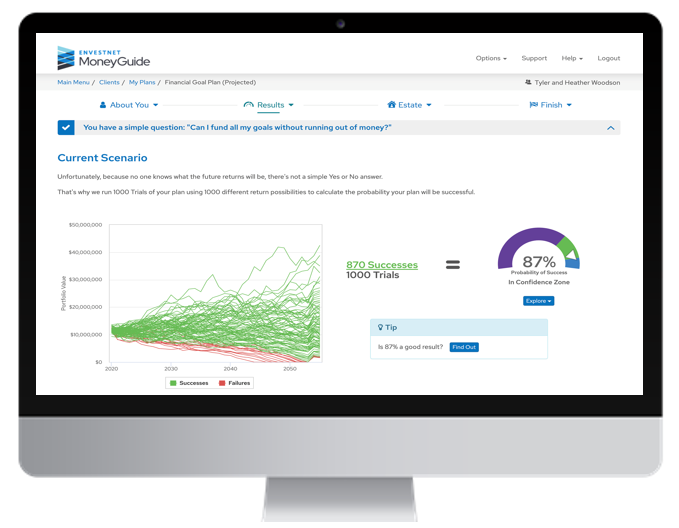

Financial Planning: The Benefits of MoneyGuide

Given that Pamela Iwaszewicz is now a CERTIFIED FINANCIAL PLANNER™ professional, we are ramping up our Financial Planning offering. We are proud to extend this as a high-level, complimentary service to you and your immediate family members. Even more, we are now partnered with MoneyGuide, one of the most widely used and trusted financial planning platforms in the industry. Its powerful software allows us to interactively work with you to prepare your unique financial plan and make timely updates along the way.

Financial planning can help answer your important questions such as: When will I be able to retire and how much will I need? How realistic are my spending goals? What are the best ways to save for retirement? We look forward to hearing from you, should you be interested in learning more about this service.

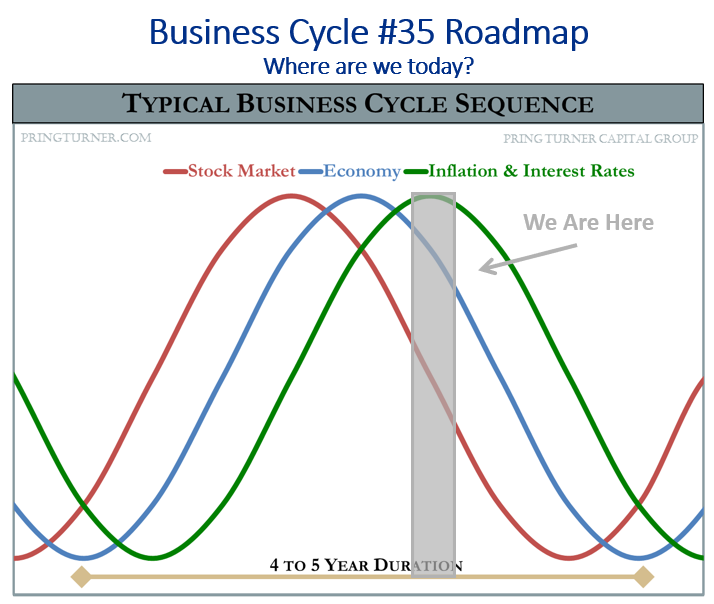

Business Cycle #35 Roadmap

Houston… We Have A Problem!

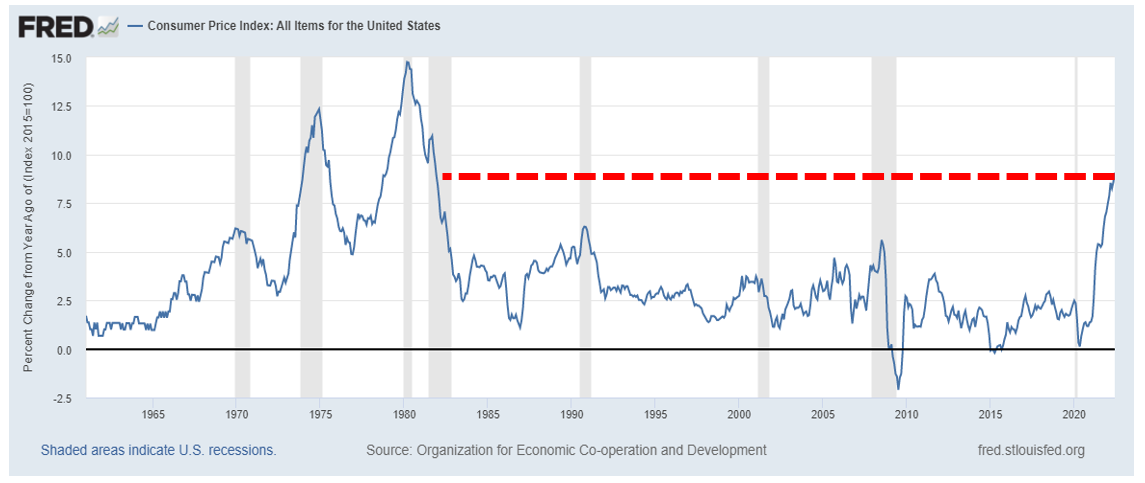

The Federal Reserve’s dual mandate is ‘to promote maximum employment and stable prices. When prices, measured by the Consumer Price Index is unstable and running far above desired levels the Fed will raise interest rates to slow the economy and consumer demand. In June 2022, inflation hit 9.2%, which was much higher than the Fed’s 2% target. The pathway to get the “inflation genie back in the bottle” could take time and in Chairman Powell’s words: “The process is likely to involve some pain…”.

One concern of ours is a possible re-run of the 1970’s inflationary economy. That deeply cyclical period included several inflation spikes with alternating good and bad financial market behavior. In essence, a “pinball economy” that bounced around erratically.

For over 45 years, we have been through all kinds of challenging economic periods: inflation, disinflation, wars, tech and housing bubbles, the great financial crisis, and even a global pandemic. That is exactly why we created an active investment process with disciplines to navigate through the inevitable rough stretches safely. Our goal is to beat inflation and protect and grow your portfolio while reducing the risks.

Financial Market Update

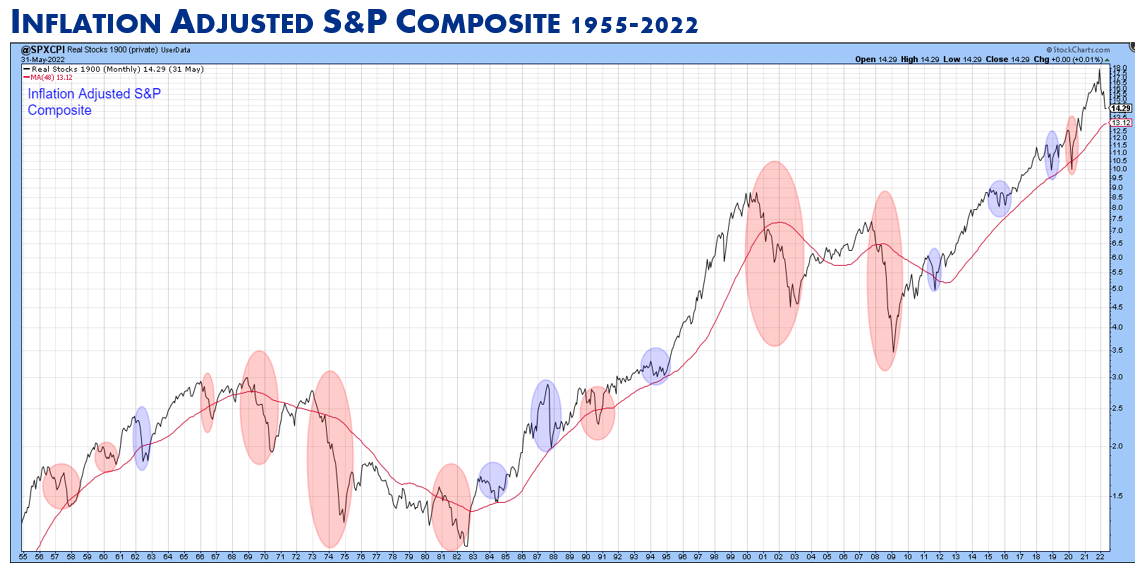

In our February 2022 client event, we introduced the analogy of market declines as “Burglars” (mild declines shown in blue ellipticals) and “Bank Robbers” (severe declines shown in red ellipticals). Burglars are temporary setbacks that recover quickly, while Bank Robbers are deeper declines and take much longer to recover. Bank Robbers tend to show up during inflationary periods like in the 1970’s. This chart depicts the inflation-adjusted price of the S&P 500. Notice how the good (green arrows) and bad (red arrows) stock market periods have alternated since the mid-1950’s. We are on alert for a repeat of the challenging environment of the 70’s over the next decade, especially if inflation proves more durable than the Fed desires.

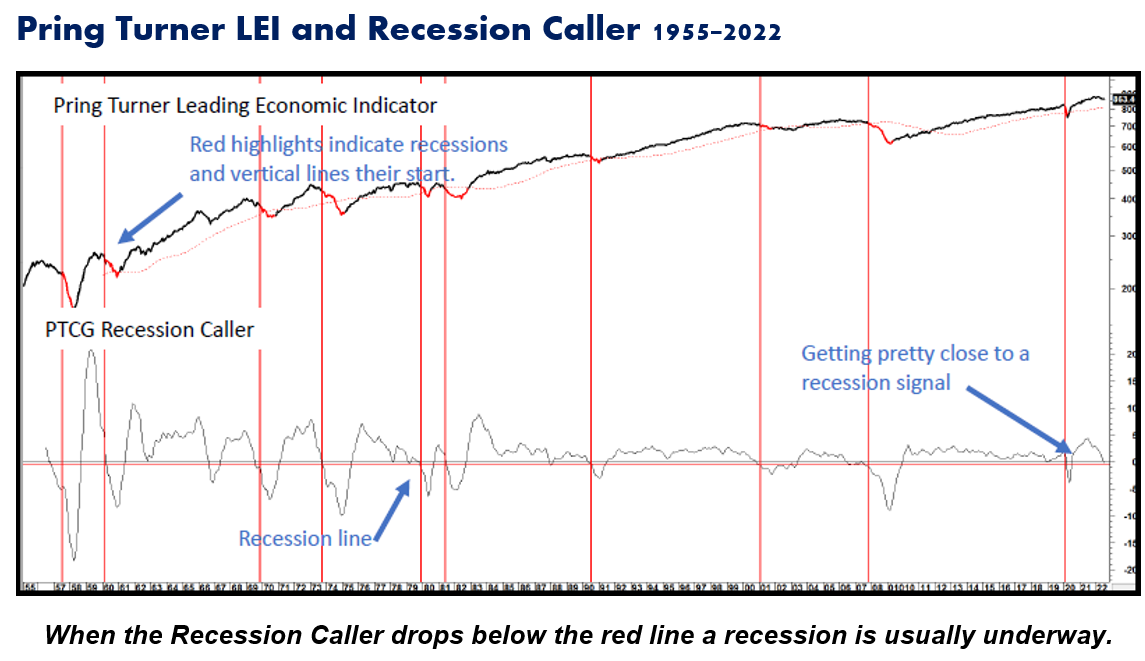

Since February 2022, the Pring Turner Leading Economic Indicator and Recession Caller Indicator have dropped sharply. The Recession Caller Indicator is composed of several reliable leading indicators including retail sales, housing, labor, and the stock market. Once the Recession Caller falls below the horizontal red recession line, a recession is usually underway. We are very close to that level now. If trends continue downward, we could be in recession territory by year-end or early next year. On the other hand, it could reverse direction and move higher first, therefore deferring the start of a recession. But that seems a less likely scenario, with the Fed on a mission to curb inflation by continuing to raise interest rates.

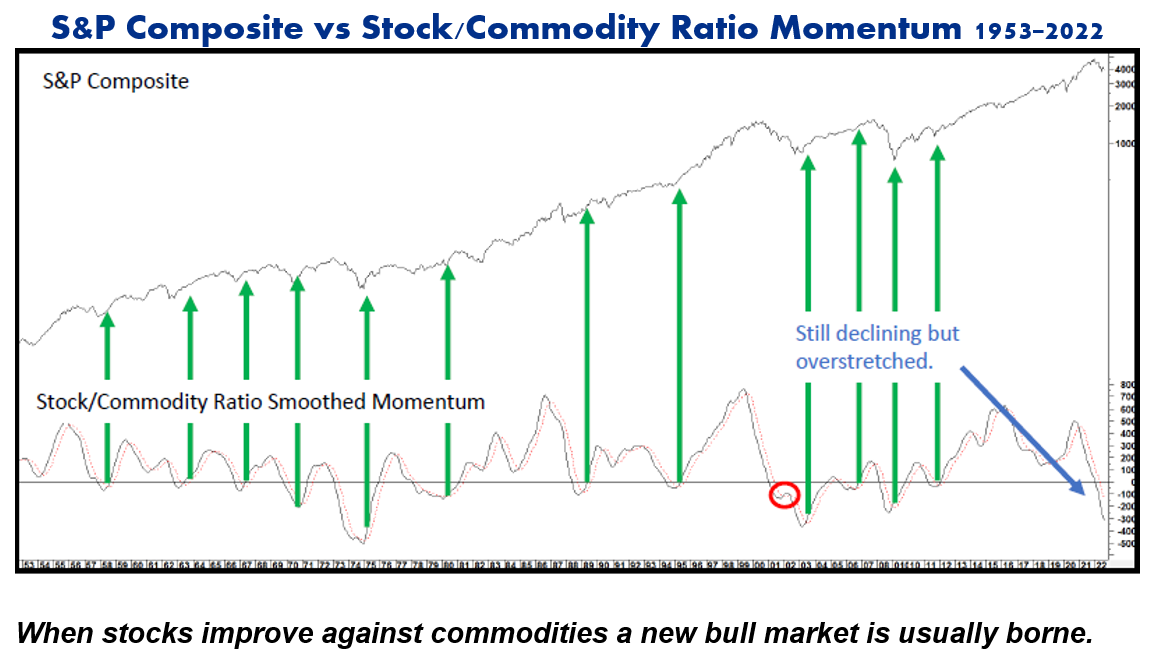

The stock market is a leading indicator and declines before the economy goes into recession. It also usually anticipates recoveries and starts a new bull market, even while we are in the middle of a recession. So, what tools can we use to anticipate the next bull market for stocks? One indicator that we like to follow is a ratio of stocks to commodities. This chart highlights (green arrows) the times this ratio’s momentum bottomed out. It is not perfect but has a good track record of signaling better times ahead for stock investors. This indicator is currently overstretched to the downside, while it is still declining. We are watching this and many other indicators for signs of things turning up, which would indicate improved stock market conditions.

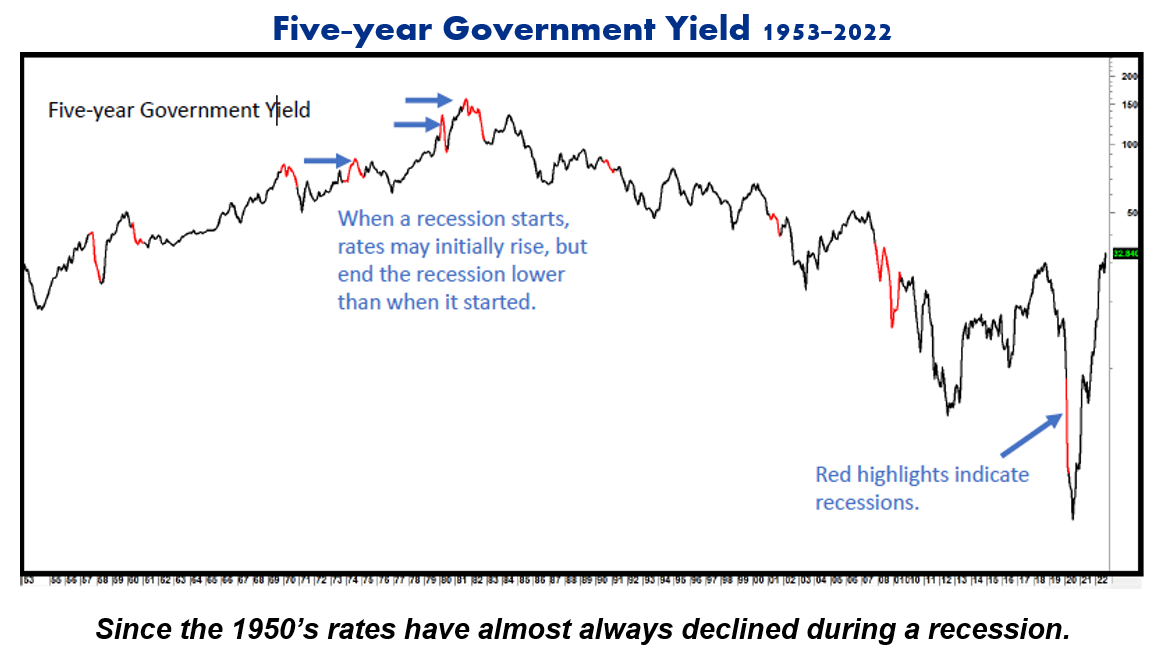

Turning our attention to bonds, let us take a look at how recessions impact interest rates. This chart, dating back to the early 1950’s, depicts the 5-year U.S. Treasury Note yield. The red highlights in the chart indicate recessions. Interest rates ultimately move lower (and bond prices higher) during recessionary periods. Recently, you can see the yield spike from nearly 0% in 2020 to above 3.25% today. For the first time in several years, we view treasury yields as reasonably attractive and that now is a good time to gradually build or add to your bond ladder.

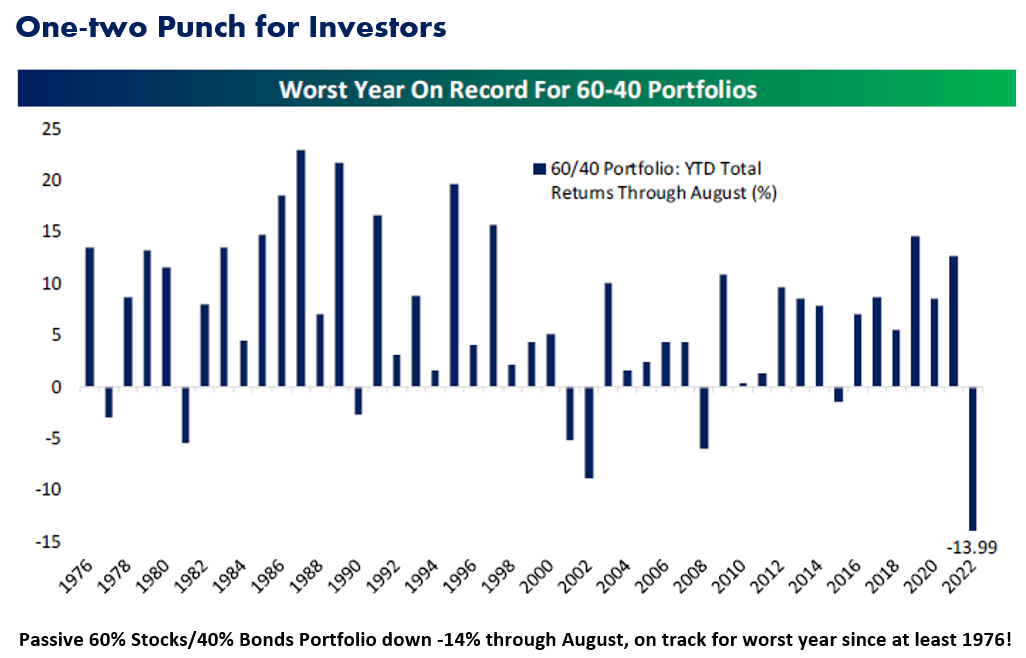

Through August 2022, both the stock and bond markets experienced significant losses as inflation and interest rates moved higher. In fact, a conservative, passively invested portfolio invested in 60% stocks and 40% bonds would have suffered the worst year since at least 1976! This “balanced” 60/40 portfolio benchmark declined about -14%. We would call that a real one-two punch for typical conservative investors. The good news is that Pring Turner utilizes a pro-active investment process with many layers of risk management. It is years like this that remind us of why we embrace a pro-active, conservative investment strategy for your portfolio.

Over the years, Martin developed barometers for each of the major asset classes to help us understand where we are in the business cycle. The key benefit is to help gauge risk versus reward in the markets. Using a weather analogy, the barometers started the year with sunny skies and portfolios were positioned in “Growth” mode. The barometers ultimately moved down to “Caution” and now, into “Protect” mode. All the while, we took incremental steps to trim stock holdings and raise extra cash levels for you. As interest rates rose and U.S. Treasury Note yields became more attractive, we added to your short-to-intermediate term bond ladder.

With our barometers still in “Protect” mode, additional defensive steps may be in store. These increasingly defensive steps help stabilize portfolios, temper further market declines, and give us extra cash to invest in new low-risk investment opportunities as the backdrop improves. When the skies clear and our market barometers once again point to “Growth” mode, we will be prepared to take advantage of the many bargain prices that are beginning to show up.

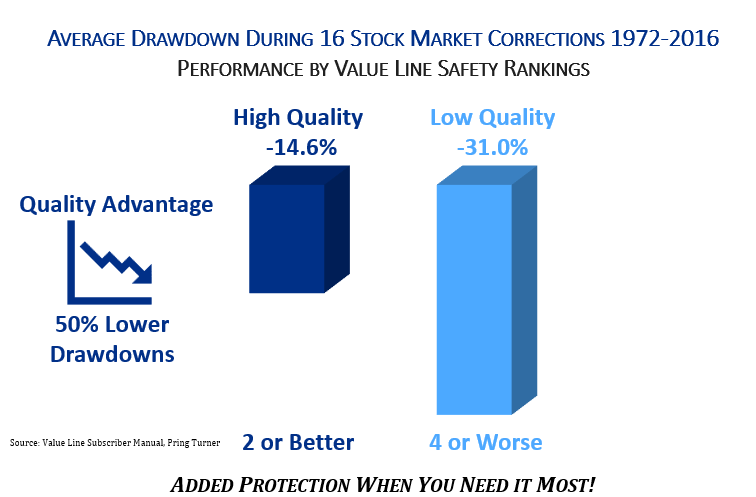

Another layer of protection provided during this challenging year is our emphasis on Quality, Value, and Income. The results from a ValueLine research study compares the performance of high-quality stocks versus low-quality ones through sixteen prior stock market corrections since 1972. High quality stocks decline significantly less during volatile market periods – better yet, they often pay dependable dividend income while we wait for stock prices to rise again. So far this year, this relationship is working just as expected: more protection when you need it the most!

PRING TURNER MISSION: PROTECT & GROW YOURWEALTH

For more than 45 years, the Pring Turner investment mission remains to both protect and grow your wealth. The whole basis of the pro-active business cycle strategy, featuring select high quality investments, is to protect portfolios through the bad periods. That makes it easier and quicker to get back to new highs during the good periods that follow. During the worst year for both stocks and bonds combined since at least 1976, major indexes or benchmarks (i.e., the 60/40 portfolio) will take much longer to recover. The famous quote from legendary value investor, Shelby Davis, certainly rings true: “You make most of your money in a bear market, you just don’t realize it at the time.”

Conclusion

Today’s bout of stagflation requires diligence, discipline, and active investment management tactics to safely navigate the difficult periods. When you add in a dose of patience, you substantially improve the odds of beating inflation and building wealth over the long-term. Now, in our 45th year of working with wonderful clients, we are proud to say that we continue to deliver on our promise to both protect and grow your hard-earned wealth. We give thanks for the confidence and trust you have given us to support you on your financial journey. Thank you!