Typical Pring Turner client portfolios glided smoothly and profitably through the first quarter and finished nicely higher. The typical Pring Turner client once again reached another new high benchmark in wealth (adjusting for deposits and withdrawals). Helping results, bonds were strongly positive in the quarter. Stock sectors that also boosted your portfolio to new high levels were the commodity and natural resource related areas, especially precious metals and energy. We expect these stocks will continue adding to your portfolio profits.

The battle today in the financial markets is the struggle to find the tipping point between the forces of deflation or inflation (See Diagram). Central bankers around the globe are making concerted efforts to lift their respective economies out of the lingering deflationary effects left behind from the financial crisis of 2008-2009. Recent leading economic data from around the world points toward a budding synchronized global expansion for the first time in six years. As we move further into 2014, global tailwinds also support the strengthening U.S. economy and tipping the balance closer to higher inflation.

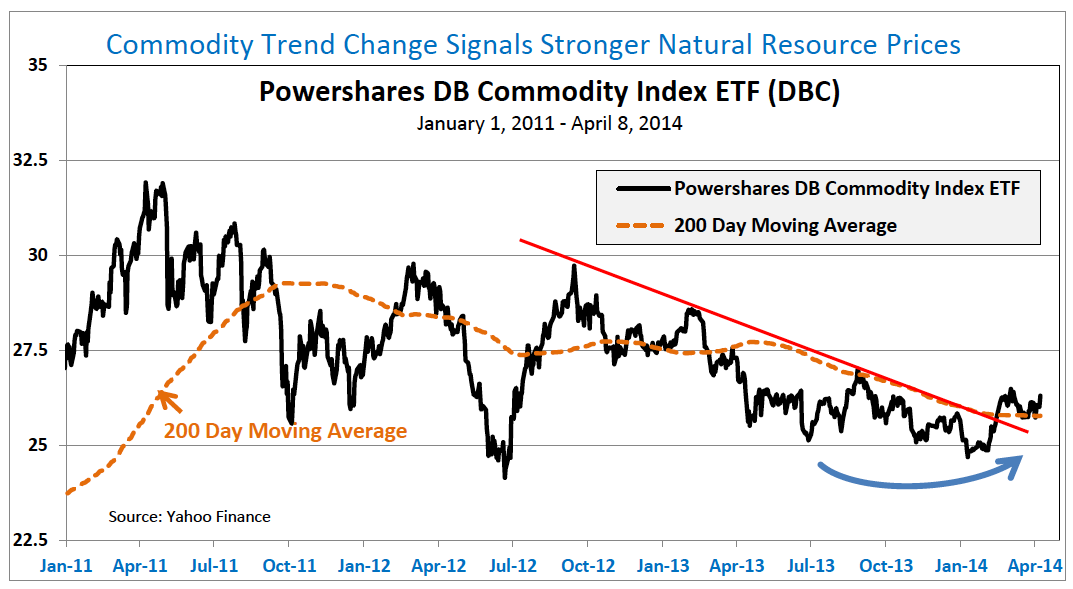

Commodity and resource based equities put in a strong first quarter performance after three years of cyclical declines. The chart on top of page 2 illustrates the recent multi-year change in trend signaling a new primary bull market is developing in commodities. Market behavior confirms the historical inflationary Stage 4 part of the business cycle is flexing its muscles and we believe will be a durable winning theme for investors. Global growth and recovery support resurgence in raw material demand and is the catalyst for continued outperformance of the natural resource sectors. These themes are well represented in your Pring Turner portfolio.

Recent turmoil in Eastern Europe is not likely to deter the global economic improvement seen in Asia, Western Europe and the U.S. We expect the cyclical bull market for stocks to continue running its’ upward course, albeit at a slower pace. The U.S. economic expansion will not be derailed by the crisis in far-away Ukraine.

Growing and Protecting Wealth

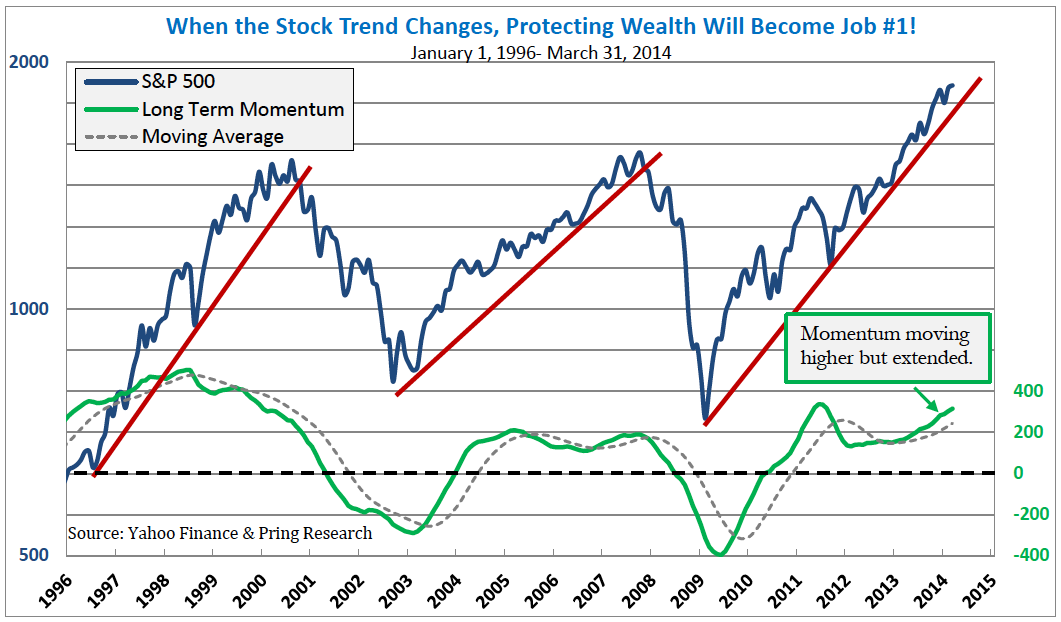

Pring Turner is pleased with this quarter’s performance resulting in the typical Pring Turner client portfolio achieving new all-time high levels. Importantly, and looking longer term this is a direct result of doing a good job protecting your portfolio through the periodic cyclical declines (bear markets). The challenge for us is to continuously accomplish our dual mandate—to both protect and grow your valuable assets. Long time clients know we have delivered on that objective. History illustrates the deeply cyclical up and down nature of financial markets. We are sensitive to the fact one cannot extrapolate the past 5 year cyclic bull forever into the future. The chart on top of page 3 is a reminder that all good markets are interrupted with periodic, oftentimes painful declines. We are on alert to any changes in evidence that would focus our tactics to change from growing to protecting your portfolio. The benefit of following the business cycle is our attention to always look forward to the next big turning point. As the evidence changes, risk management and protection of hard earned wealth will become foremost in our proactive decision-making. This disciplined strategy is the cornerstone to helping you reach your financial goals with peace of mind.

Our Mission

Pring Turner looks forward to the challenges and opportunities that lie ahead. We are committed in our quest to continually improve our service and performance for you. The principals at Pring Turner Capital remain dedicated to a conservative investment philosophy and our decision making process has stayed consistent throughout the firm’s 37 year history.

The organization stands ready to both grow and protect your valuable assets in the years ahead. We take the responsibility of managing your wealth and earning your trust very seriously. Your confidence and trust are deeply appreciated. As always, please feel free to contact us with any questions regarding your portfolio.

Pring Turner Activity Update

It was a busy quarter for the Pring Turner team. We were invited to present our investment outlook at conferences all around the world. To kick off 2014, we spoke to the San Francisco Technical Securities Analyst Association and $ums in Retirement (SIR) in Walnut Creek. Later on in February Martin Pring presented at the TD Ameritrade conference for financial professionals in Orlando, Florida. In March, the team spoke to the International Federation of Technical Analysts in five European financial center cities and three chapters of the American Association of Individual Investors (AAII) in Florida. We appreciate the opportunity to share our business cycle research with all kinds of investment groups. If your own group is interested in having a member of Pring Turner share our research, please send us an invitation.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.