Happy New Decade! We are pleased to report you finished the year with a very strong performance. Congratulations!

We caution against extrapolating last year’s strong performance into 2020, just as we advised against extrapolating further falling stock prices in our January 2019 newsletter. Stock prices are entitled to take a short breather after last year’s extraordinary stock market rally. One element that stands out in contrast to the start of last year is the level of investor confidence. A year ago, amid a short but deep stock market correction and with abundant talk of recession, investor psychology was intensely fearful.

How quickly market psychology can change! Today, opposite conditions are readily apparent. Fear has been replaced with extremely high levels of greed as surveys of both professional and individual investors indicate intense optimism. Historically, just as excessive levels of fear can be a contrarily positive signal for future stock prices, excessive optimism can be a contrarily negative signal for future returns. Near term, we would not be surprised to see stocks consolidate some of the recent gains and pull back in price. However, looking out over the full year and beyond, it will be important for investors to stay optimistic. Here is why we still see the glass as half-full.

Reasons to Stay Optimistic

History teaches that business cycles do not die of old age, despite that this economic expansion has passed the ten-year mark; rather, they end with an overheating economy and the Federal Reserve pushing interest rates too high. Neither of those conditions are the case today. Instead, after cutting interest rates three times in 2019, we expect the Federal Reserve to keep rates steady at low levels—a positive backdrop for the economy. All the while, consumer balance sheets are in excellent shape, mortgage rates are quite attractive and jobs are still plentiful, all of which reinforce the growth outlook.

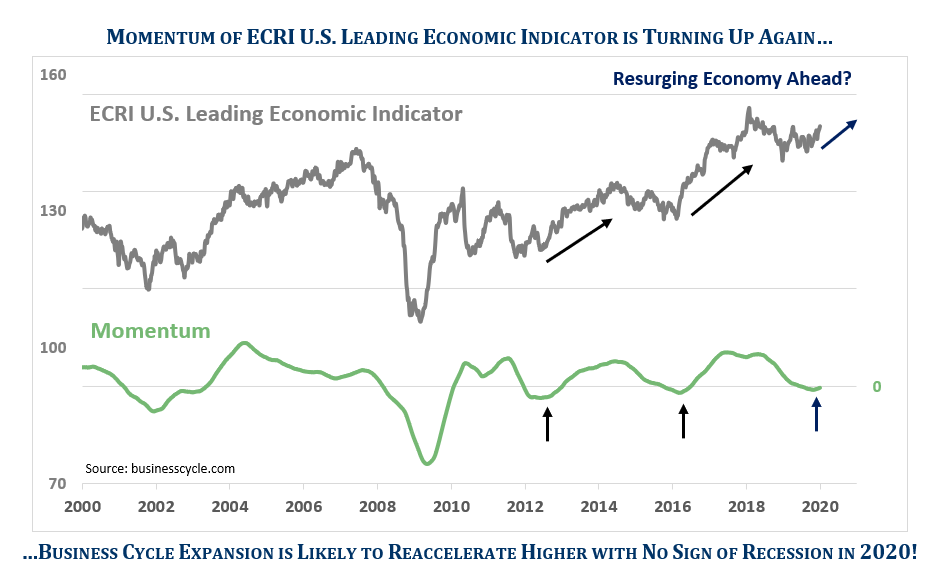

In addition, our most recent business cycle research continues to show evidence of resurging economic momentum. A prominent leading indicator published by the Economic Cycle Research Institute (ECRI) is once again in the process of breaking out to the upside. Long-term momentum has started to turn up in this reliable leading economic indicator, after the third growth slowdown of the last decade. This gauge complements the evidence we presented in both our July newsletter – Climbing the Wall of Worry to New All-Time Highs and October newsletter – Adding to Gains – namely that the economy is set to rebound after a lengthy slowdown in growth. Each prior yet similar period was followed by a prolonged extension to the economic cycle and higher stock prices.

Moreover, as 2020 begins we see evidence that commodity prices are finally gaining traction and stand ready to potentially join the stock market party. A resurging economic backdrop acts as a tailwind for materials, energy and other economically sensitive areas of the market. We will continue to monitor this evidence and use any short-term market correction as an opportunity to add these emerging themes to your diversified portfolio.

Summary

In today’s historic low interest rate world and with the prospect of re-accelerating economic strength, stocks remain our asset class of choice over bonds. While we could experience a consolidation of last year’s strong gains early in the year, this may well allow the stock market more upside potential as the year progresses. We will continue to search for and evaluate additional conservative growth and income ideas to purchase for you.

While 2019 is a memorable one for the history books, the last twenty years included numerous cyclical ups and downs that raised havoc on many investors. Indeed, the first decade included a tech bubble collapse and severe financial crisis leading to two brutal 50%+ stock market routs. In the recent decade, there were three nearly 20% declines, which tested investor discipline. More importantly, our client family earned those steady returns all while experiencing roughly half the stock market volatility*.

Those consistent long-term results came from making timely adjustments to your investments as the economic landscape changed. Additionally, the focus on investments that combine the key elements of high-quality, reasonable value and dependable dividend income also help generate better returns for you with less risk. Now in our 43rd year, we have used this formula successfully in many different, even extreme, financial, economic and political climates. We are proud of past investment results and dedicated to doing even better for you in the years ahead!

Lastly, we would like to take this opportunity to welcome all newcomers to the Pring Turner family. Thank you for the opportunity to help you achieve your financial goals with peace of mind! We appreciate the fact that Pring Turner could not be as successful without wonderful clients like you who have the patience, perseverance, and loyalty to stick with our conservative investment strategy through the inevitable ups and downs of investing. We value your confidence and will work hard to continue to earn your trust each day. As always, please feel free to contact us should your circumstances change or if you have any questions.

Here is a toast to a happy, healthy and prosperous 2020!

Did you like this article?

Photo by Jamie Street on Unsplash