In light of the dramatic stock market sell off we wanted to bring you up to date on our thinking. In our most recent update we reported many short-term technical market indicators had reached oversold levels and the stage was set for a stock market rebound. However, every brief rally has given way to continued weakness.

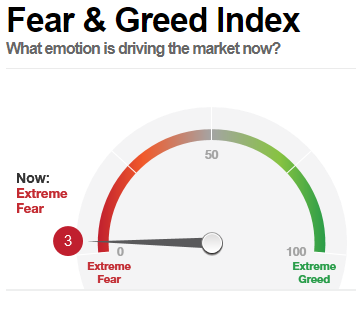

The additional decline for stocks this month has left the markets extremely stretched on the downside. In technical terms, this is an oversold condition that occurs on rare occasions often coinciding with investor panic. We like to say that the stock market is nothing more than fear and greed superimposed on the business cycle. Where are we today? CNN Business publishes a “Fear & Greed Index” (pictured below), which attempts to measure the current emotional state of investors. It can range from a maximum “Greed” reading of 100 to a maximum “Fear” reading of 0. The most recent reading (3), clearly demonstrates that fear reigns supreme and historically this level of extreme fear has been an excellent indicator for future stock market returns.

Source: money.cnn.com

Turn Your Emotions Upside/Down

When the Fear and Greed index has been below 15, stocks have earned higher returns when compared to other more muted readings. Legendary value investor, Warren Buffett’s famous quote comes to mind, “Be fearful when others are greedy and be greedy when others are fearful.”

We know it is terribly hard to hold steady at times like these, but we believe the prudent course is to stay patient. Looking past current volatility, while the market deals in probabilities, not certainties, the probabilities favor a strong relief rally can begin soon. We will be watching closely to see if the market can regain healthy upside momentum. In the meantime your investment portfolio is diversified with many high quality stocks and bonds. That combination will produce dependable income while we patiently wait for long term capital gains to accrue.

We appreciate your patience, perseverance, and loyalty to stick with your investment process through the inevitable ups and downs of investing.

Looking forward to a Happy and Prosperous 2019!

Photo by Priscilla Du Preez on Unsplash