The stock market moved in a wide range during the first quarter, but for all the gyrations the net effect was quite mild. By our rough calculation, the Dow Jones Average tacked back and forth more than 8200 points on a closing basis during the first quarter of 2015! Despite violent day-to-day price fluctuations this well-known index finished down a trifling 47 points. By comparison, the S&P 500 notched a slight gain in the first quarter. Recent sideways price action seems to reflect the same behavior investors have been witnessing for several months now. For all the volatility, stocks have been relatively range bound since mid-November of last year. Why have stocks stalled out recently and what’s ahead?

What’s Ahead

First, six years into this economic recovery the growth rate is still painfully slow. The big concern facing investors is how to judge the Federal Reserve’s actions to begin taking away the punch bowl from the party. The “tapering” of QE (Quantitative Easing) was completed last fall, removing one extraordinarily accommodative policy measure in place since 2008. It is not a coincidence markets took notice and stalled out. For now, the big question for stock investors is when will the Fed take the next step and begin a process to tighten policy by raising interest rates? The Fed concluded its March 18th meeting by announcing it was signaling a new tone by again re-assessing plans to begin raising rates. Can the economy withstand rising interest rates at this time? It’s pretty clear the Fed is as unsure as anyone, but you can be sure they will initiate any tightening process very cautiously. In our view, any lifting of interest rates later this year will be mostly symbolic and amount to mere token hikes.

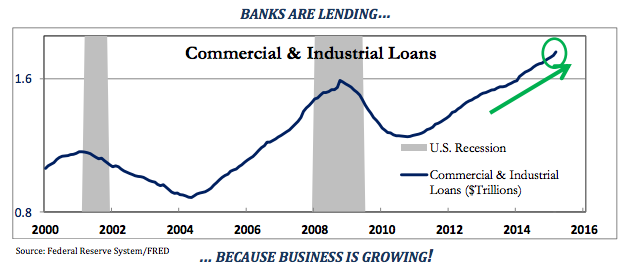

In fact, rising interest rates should be seen as a welcome sign that economic growth is continuing to press higher. Higher economic growth means higher demand for money and recent bank lending activity illustrates this encouraging trend (see chart). Individuals and businesses alike are borrowing more money based upon their confidence in continued positive economic conditions. Our opinion is a minor hiccup in interest rates and initial reversal in Fed policy is highly unlikely to derail the economy or stock market.

“Wall Street analysts to make their deepest cuts to earnings forecasts since the financial crisis…Analysts, citing the dollar’s strength as a key factor, are predicting that profits at S&P 500 firms for the first quarter will show their biggest annual decline since the third quarter of 2009.”

–The Wall Street Journal, March 22, 2015

Second, stock prices face the fact earnings growth is coming under pressure. Thanks in large part to an implosion in energy share profits; the S&P 500 annualized earnings growth rate is tailing off and could very well drop below zero. For the first time since this bull market kicked off in 2009, stocks are experiencing a year-over-year earnings decline. In the past, profit declines and economic recessions tend to appear together and we are watchful for any additional warning signs. The question the above quoted Wall Street Journal does not answer is does the swift decline in 2015 earnings growth estimates portend an overall recession ahead, or just a temporary slowdown in profits? Pring Turner’s view is any earnings decline is temporary and profits will very likely rebound substantially in the second half of the year. The combination of still low interest rates, low energy costs and continued pent up demand for spending will lead to an extension of the economic recovery and bull market for stocks.

As always, to help gauge risk versus reward we will take our cue from the action of our stock barometer, a model comprised of several indicators designed to evaluate the stock market environment. The principal function of the barometer is to warn of cyclical bull and bear markets as much as possible. The model assumes when markets turn, they usually do so in a relatively slow and deliberate fashion. Although not perfect, the stock barometer has a very credible long-term track record. The current stock barometer reading continues to sit at a still positive reading of 50 (measured from 0-100), and recent data show some tentative improvement in the underlying components. Your portfolio is currently offensively allocated to take advantage of a continuing bull market.

The unique benefit of Pring Turner’s investment strategy is the wide flexibility to adapt the portfolio to a changing environment. We stand ready to make strategic changes in your portfolio as we continue to move through the business cycle and our barometer work changes. We expect the economy and stock market will ultimately shift into a higher gear and re-accelerate as the concerns responsible for choppy market action the last several quarters are digested. Patient shareholders will be rewarded.

Thank you for your confidence and placing with us the important responsibility of protecting and growing your wealth. Please let us know if you should have any questions regarding your portfolio or if your personal circumstances should change.

Click the following link to download the PDF version of the newsletter:

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.