Despite alarming news stories, our leading economic and market indicators are now pointing towards improving conditions and upside opportunities.

Although stocks experienced a strong rally from October to early February, they struggled through the remainder of the first quarter. Market volatility spiked with the sudden news of the Silicon Valley Bank (SVB)’s failure – the 17th largest bank in the country. An old-fashioned bank run on deposits crippled SVB and quickly spread to several other questionable banks. Since banks play a crucial role in providing financing to individuals and businesses, liquidity crises like these can have severe consequences for the economy. Thus, the U.S. Treasury and Federal Reserve quickly set up the Bank Term Funding Program (BTFP), which provides additional liquidity via loans to banks, savings associations, and credit unions. So far, these measures have helped to calm bank depositors and investors. Despite lingering fears and pessimism, we are increasingly optimistic that the stock market can continue on a bullish track.

“It’s only when the tide goes out that you learn who’s been swimming naked.”

– Warren Buffett

Warren Buffett’s famous quote is particularly relevant in understanding the recent banking crisis. During tough times, such as this current sharply increasing interest rate cycle, investors discover which companies were not as financially stable as they originally appeared during the good times. Similar to how someone without their swimming trunks will be exposed when the tide goes out, weaker companies will be revealed when the economic tide recedes.

What then caused the sudden banking emergency? Undoubtedly, the Federal Reserve’s steep interest rate tightening-cycle played a role in the sudden turmoil. Some banks were unprepared for an environment where the Federal Funds interest rate would rise from zero to almost 5% within a year. The highest rates since before the Great Financial Crisis wreaked havoc on banks’ mortgage and bond portfolios. Simply put: some poorly led banks failed to adequately manage their portfolio risk as interest rates soared.

Happily, this was not the case with your portfolio. Our bond strategy aimed to minimize risk by avoiding longer-dated bonds as interest rates rose. Over the past year, your shorter-term U.S. Treasury bond ladder was built to mitigate much of the interest rate risk, while securing quality, stable income for you in the coming years.

What’s Next?

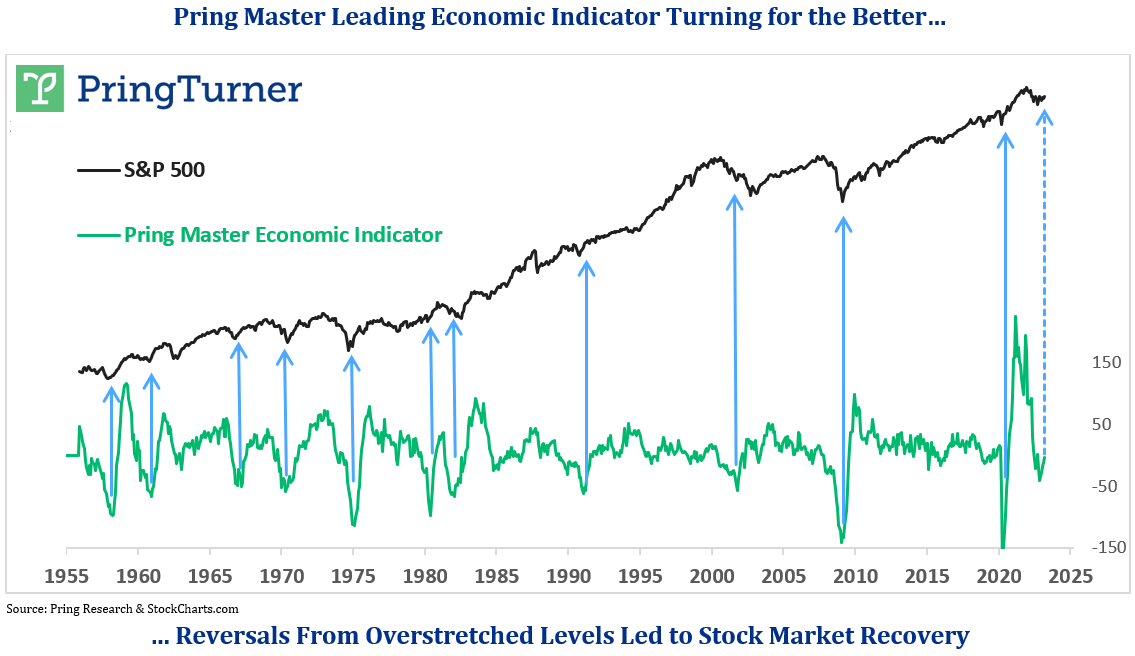

One positive byproduct of the recent banking turmoil is that interest rates have probably peaked for this business cycle. Lower rates will serve to reinvigorate a slow-growth economy that is taking an added hit from the disruptive bank-liquidity challenges. The good news is we can see evidence of an improving economic outlook in our proprietary Pring Master Leading Economic Indicator. Developed by our partner, Martin Pring, this blend of leading economic indicators gives reliable signals of early economic turning points. Recently, this valuable tool turned up from an overstretched reading—a rare occurrence that typically takes place around major stock market turning points.

Although not intended to be a precise timing model, the indicator is beneficial in identifying economic recoveries. Now flashing the twelfth positive reading since 1955, this indicates that the economy is primed to accelerate higher, along with stock prices.

Investment Tactics

In our January newsletter titled, “2023 — A Transition Year,” we suggested that there would likely be changes in portfolio emphasis from defense to offense. We stated, “… we believe 2023 will be a transition year for financial markets where our investment tactics will, at some point, likely shift from protect to growth-mode.” In that letter, we featured the Pring Turner Advanced Investment Barometer™ (AIB™), which showed initial improvement in conditions for stock prices. Since then, the AIB™ has continued to progress higher, an encouraging indication that the primary trend for stocks is turning up. This is one reason why you may have noticed some recent investment activity in your portfolio. Our plan is to gradually take advantage of certain stocks and sectors that offer a combination of quality, value, and income. This gradual shift from defense to offense is designed to help build your wealth as the economy and stock market reaccelerate higher.

Summary

This quarter, a sudden liquidity crisis in the banking sector caused a spike in financial market volatility. However, your well-diversified portfolio, consisting of high-quality stocks, shorter-term bonds, and ample cash reserves held up well during this challenging period. Despite alarming news stories, our leading economic and market indicators are now pointing towards improving conditions and upside opportunities. Over the last fifteen months, we have been patiently waiting for the financial storm clouds to clear. As long as conditions and our trusted market indicators remain positive, we plan to gradually increase your stock investments to help build your wealth. We are excited for what the year ahead will bring.

Most especially, we would like to express our gratitude for your confidence and the opportunity to serve as your trusted financial advisor. Please do not hesitate to contact Katie, Tom, Jim, or Pamela if your circumstances change or you have any questions. We are always happy to listen and help!

Congratulations Martin

It is with great pleasure and pride that we extend our warmest congratulations to Martin Pring for earning the International Federation of Technical Analysts Lifetime Achievement Award! Martin will receive the award this fall at the IFTA annual conference in Jakarta, India. This is truly a remarkable accomplishment – a testament to Martin’s decades-long dedication to the study of technical analysis, business cycles and financial market behavior.

The Pring Turner Team is incredibly grateful to have worked alongside our friend, Partner, and, indeed, legendary research analyst these past 35 years. Martin’s market insights, models, barometers, and indicators have helped us navigate through the many ups and downs of the financial markets. We have come to rely on his research work as an essential component of our pro-active investment strategy that is designed to protect and grow your wealth.

Martin, this award is a well-deserved recognition of your many achievements and serves as an inspiration to us all who have had the privilege of working alongside you. Once again, congratulations on earning this prestigious award! We are so proud of you!

Don't miss out! Join our community today to stay up-to-date with our latest articles and insights!

No Fields Found.