You can watch the entire 5+ minute video by clicking the play button below or keep reading for the executive summary.

As we move into March, market volatility has taken center stage, raising questions and concerns among investors. Recent fluctuations have been driven by a combination of policy shifts, economic uncertainty, and shifting investor sentiment. While these market moves may seem unsettling, history reminds us that volatility is a normal and expected part of investing.

Understanding the Current Market Environment

A key factor contributing to recent market turbulence is the transition to a new administration, which has introduced rapid policy changes, including new tariff discussions. Investors are weighing the potential impact of these policies, leading to increased uncertainty and sharper market swings.

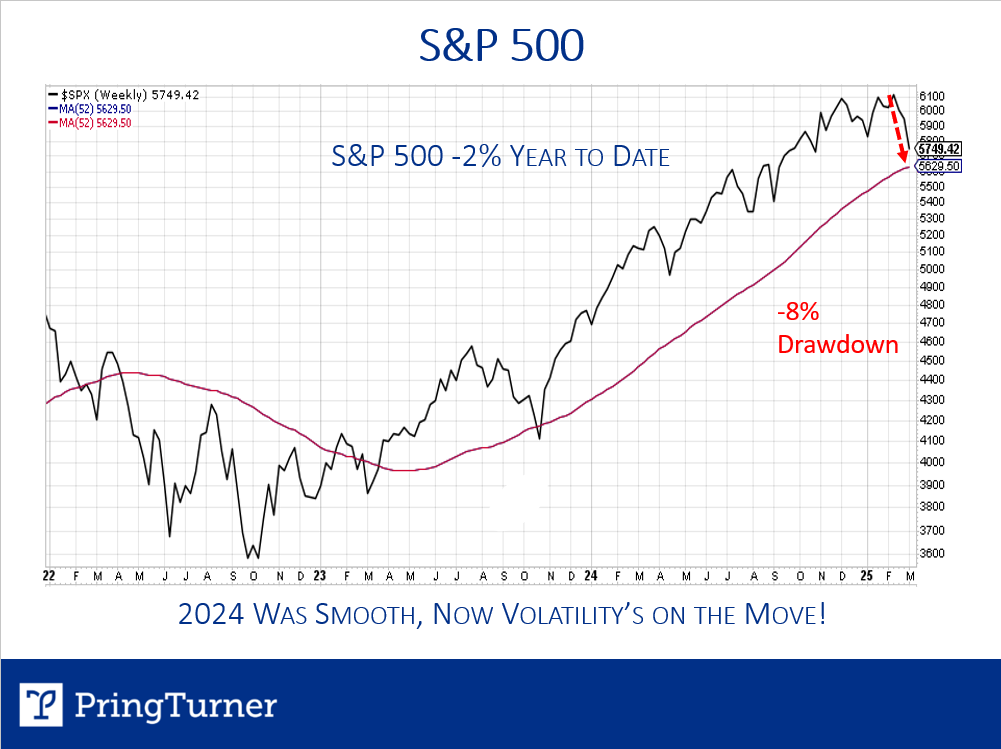

In January, we highlighted that the past two years had been unusually stable, with very few meaningful corrections. As anticipated, 2025 has ushered in a return to more typical market volatility. Over the past few weeks, the S&P 500 has declined by approximately 8%, marking a more substantial pullback than we saw throughout all of 2024. As of mid-March, the index is down around 2% year to date.

While short-term declines can be unsettling, history shows that these corrections are often a precursor to the next market recovery.

Market Corrections Are Normal

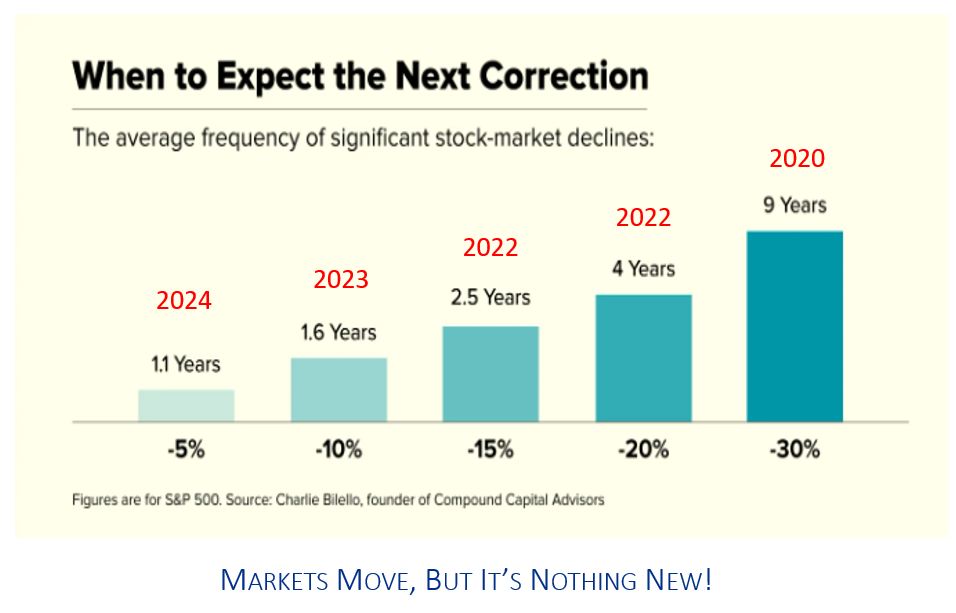

Market downturns are not unusual; in fact, they occur with predictable regularity:

- 5% declines happen about once per year

- 10% declines occur roughly every 1.5 years

- 15% declines take place about every 2.5 years

- 20% declines occur approximately every four years

- 30%+ declines are less frequent, happening about once per decade

Looking back at recent years, these historical patterns hold true:

- 2024: A 5% drawdown

- 2023: A 10% drawdown

- 2022: A 20% drawdown

- 2020: The COVID crash, resulting in a 30%+ drawdown

While each correction is driven by different factors, the broader trend remains consistent: markets move through cycles, and downturns are an expected part of long-term investing.

The Silver Lining: Opportunity in Volatility

Periods of heightened market volatility can create opportunities for investors. The CNN Fear & Greed Index, which gauges investor sentiment, currently signals extreme fear—a level that has historically been associated with strong future returns.

When uncertainty is high, high-quality investments often become available at more attractive valuations. We view this pullback as an opportunity to selectively deploy capital into long-term investments. While it is impossible to predict the precise timing of a market bottom, history suggests that disciplined investors who take advantage of these moments are often rewarded.

Looking Ahead

While no two market corrections are exactly alike, uncertainty is a constant in investing. Over the past four decades, we have witnessed countless unexpected events that have temporarily disrupted markets. Yet, time and again, markets have recovered, rewarding patient and disciplined investors.

As we move into spring and summer, we remain confident in the long-term outlook. Short-term volatility should not distract from long-term investment objectives.

If you have any questions or concerns, we welcome the opportunity to discuss our perspective further. Staying informed and focused on long-term fundamentals remains the best approach in any market environment.