What is the Business Cycle?

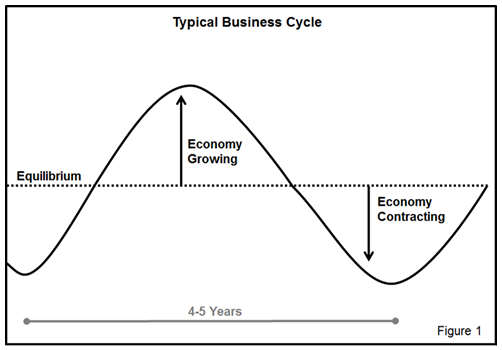

The business cycle is the normal, sequential, and repeated ups and downs of the economy. This continuous sequence has repeated over and over since the U.S. became an industrialized nation in the 18th century. A bell shaped curve provides the best illustration of the business cycle. The shape is simple, elegant and implies continuous change, with one cycle leading into the next (figure 1).

Introducing the Six Stages

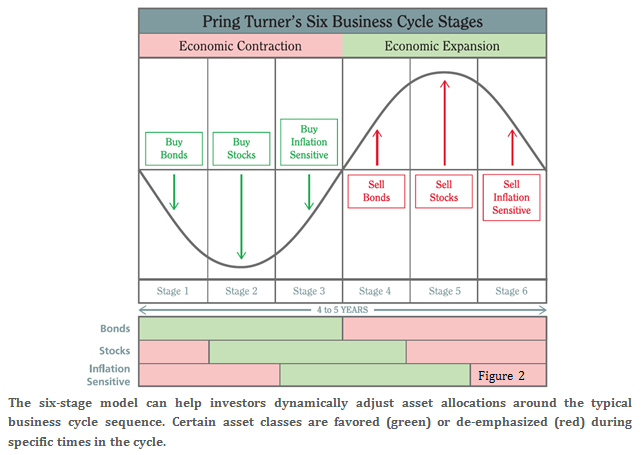

Anyone with gardening experience understands that it is difficult to plant in the winter because nothing grows. The same is true for the financial seasons in the business cycle, where investors can use knowledge of the chronological bond, stock and commodity sequence to create a financial market calendar. By better understanding these financial seasons and using the correct forecasting tools, investors can make well-informed decisions and dramatically improve their chances for investment success. Each asset class has two turning points in a given business cycle—a top and a bottom. This means that a typical cycle has a total of six junctures—three buys and three sells. We call these the Six Stages. The calendar year has four seasons, each of which has its own characteristics. The same can be said for the business cycle, except we have organized it into six stages.

How Do We Know Which Stage We Are In?

The stage of the business cycle is identified through models or “barometers” for each of the three asset classes (Bonds, Stocks and Commodities). Our barometers are constructed from proprietary technical, and inter-market relationships that have been researched all the way back to 1955 by Dow Jones Indexes. When a majority of the components within a barometer are on a “buy” signal then that asset class is considered “bullish,” and when a majority are on a “sell” signal then that asset class is considered “bearish.” The barometer performance has been stress-tested under all kinds of geopolitical turmoil, wars, economic distress, monetary conditions, and embraces periods of inflation, deflation, crashes, booms and busts. We determine the prevailing stage of the business cycle by looking at each of these barometers. Stage I occurs when bonds are bullish and stocks/commodities are bearish. Stage II occurs when bonds and stocks are bullish while commodities remain bearish. Stage III reflects when bonds, stocks and commodities are all bullish. Stages IV, V and VI inverse of this sequence. We use this stage information to establish our broad tactical asset allocations guidelines.

Applying Business Cycle Stage Shifts to Tactical Asset Allocation

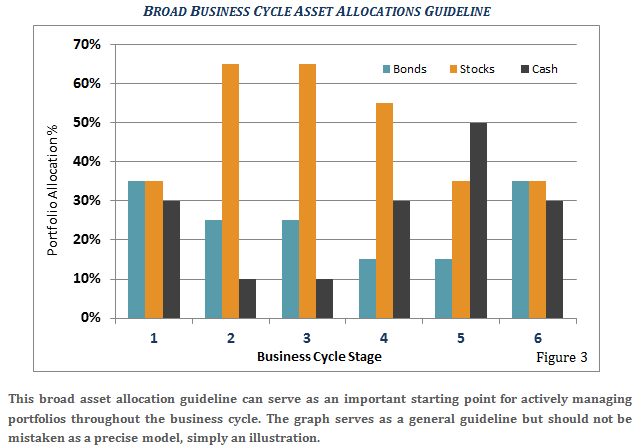

Doesn’t it make sense to reduce your exposure to stocks in anticipation of a recession and to purchase more stocks when the economy is expected to accelerate into a growth mode? For instance, during a recession in Stage 1, our asset allocation guideline includes a healthy mix of bonds and cash to stabilize portfolios. The opposite is true in Stage II and III, when the economy is moving up to full throttle and maximum exposure to stocks is recommended. We believe that our six-stage framework is an ideal way to construct an active allocation discipline, especially because it also serves as a critical risk-management tool.

Performance

In 2012, analysts at Dow Jones Indexes were intrigued with the research, and thoroughly tested the barometer data and business cycle theory going back to 1955. The results were strong enough to justify the construction of an index designed to track the strategy. The result was the Dow Jones Pring Business Cycle Index, the first proactively managed business cycle index for Dow Jones. The index incorporated a rules based system that identified the six stages and best allocated according to how each asset class and equity sector traditionally performed in every business cycle phase. Their thorough analysis found the strategy offered solid returns with less volatility for investors.

Call 1-800-700-9737 to speak with a Pring Turner Financial Advisor or...

Final Thoughts

The business cycle investment process, similar to the continually changing seasons, follows a logical sequence to make active asset allocation decisions. The approach marries our conservative investment philosophy to a disciplined decision process. Since the 1970’s, our repetitive decision making discipline has been used to profitably manage portfolios for conservative investors.

Our performance, in tandem with research provided by the folks at the Dow Jones Index organization, demonstrates that our philosophy and business cycle investment discipline provides attractive risk-adjusted returns over many cycles and years. Always being alert and anticipating the next inflection point in the business cycle creates a dynamically managed portfolio that takes advantage of emerging profit opportunities and also protects one’s wealth from the inevitable cyclical declines. Our research and investment performance are time tested and proven to benefit the “All Season” conservative investor.