Stock prices faced headwinds in the first quarter, marked by heightened volatility. Sharp market swings were largely driven by uncertainty surrounding the new administration’s shifting tariff and fiscal policies. This uncertainty has even sparked speculation about a possible recession later this year. However, we believe those concerns are premature. Later in this letter, we will explain why we remain optimistic about the economy.

Most especially, we are pleased to report that the typical Pring Turner portfolio advanced amid this market turmoil. The median Pring Turner portfolio delivered a return of +1.6%* during the first quarter, while the S&P 500 total return was -4.3%. By emphasizing quality, value, and income, your diversified portfolio is navigating the volatility relatively well. Even better, we anticipate the bull market will regain strength and drive your portfolio higher in the months ahead.

From Mag-7 to Lag-7!

There is no doubt that 2025 has been a stark contrast to 2024’s smooth ride to record highs. Think of it as transitioning from a long stretch of highway to a rugged dirt road. Last year’s high-flying technology stocks bore the brunt of the first-quarter turbulence while most other sectors actually advanced in price. In other words, more broadly diversified portfolios, like yours, performed well compared to the S&P 500 index, especially relative to the so-called “Magnificent 7” stocks.

The “Mag-7” includes META, Microsoft, Amazon, Apple, Alphabet, NVIDIA, and Tesla. Together these mega-cap growth stocks account for approximately 30% of the S&P 500 index, meaning their movements have an outsized impact on the entire market. This quarter, the “Mag-7” became the “Lag-7”, significantly underperforming the broader market.

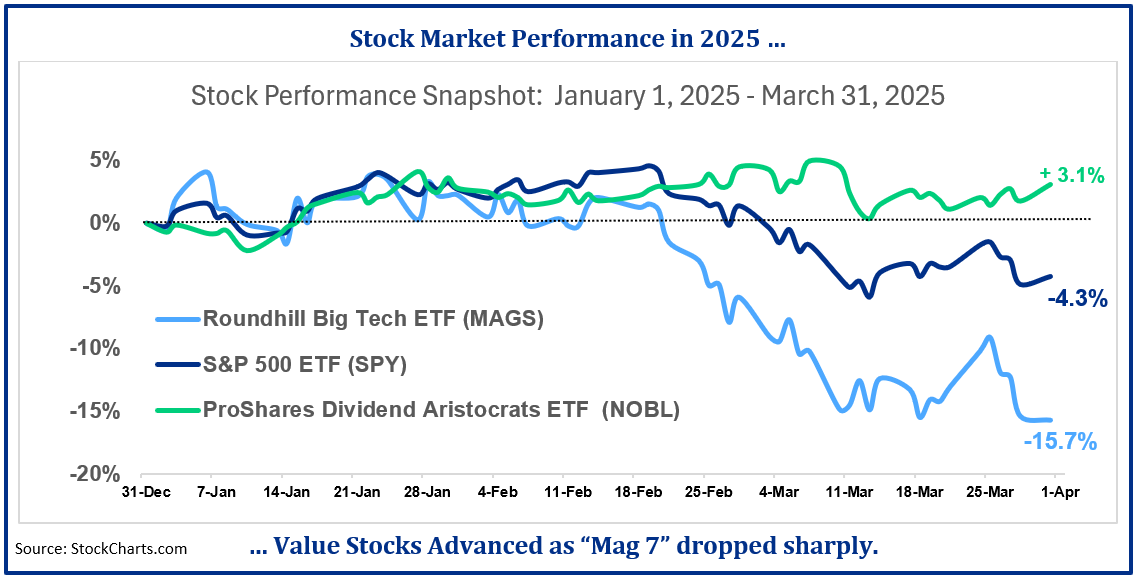

To illustrate this disparity, the following performance chart compares three ETFs:

– Roundhill Big Tech ETF (MAGS) – an index of the “Magnificent 7” stocks

– S&P 500 ETF (SPY) – a capital-weighted stock index

– ProShares Dividend Aristocrats ETF (NOBL) – an ETF that focuses on quality companies with long histories of consistent dividend increases

We have included the Dividend Aristocrats fund in the comparison because it best represents the Pring Turner investment style, emphasizing stability, quality, and dividend growth over time.

The key takeaway is that your portfolio is performing significantly better than the S&P 500 suggests. While large-cap growth stocks endured a swift and sharp decline, high-quality, dividend-paying value stocks advanced. This abrupt shift in market leadership may last quite a while—a welcome development for value investors like us.

Recession Ahead? Not Yet!

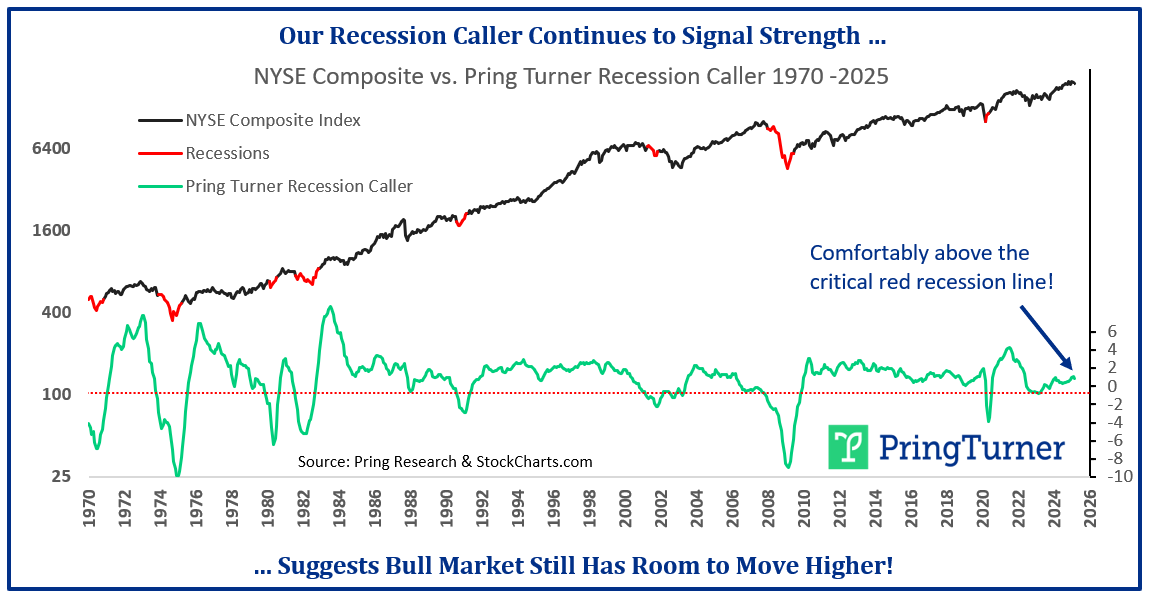

Turning to the economy, our proprietary Recession Caller indicator continues to signal strength. This reliable forecasting tool tracks four key economic components— Housing, Employment, Retail Sales, and the S&P 500 stock index—all of which are highly sensitive to economic trends.

The latest reading of this forecast tool shows the indicator comfortably above the critical red recession line, suggesting continued economic resilience.

The positive momentum of the G-7 Leading Economic Indicator (not shown) further reinforces our upbeat economic outlook. This measure tracks economic trends across the world’s seven largest developed economies, providing valuable insight into the broader global economic landscape. Taken together, the strength of these indicators suggests that recent recession predictions in the financial media may be premature.

Navigating the Fog of Uncertainty

The uncertainty surrounding tariffs and other policy issues in Washington has triggered market volatility and extreme investor fear. As we often say, “The stock market is simply fear and greed superimposed over the business cycle.” During last month’s market downturn, we issued a special bulletin highlighting CNN’s Fear and Greed Index—a useful gauge of investor sentiment that swings between emotional extremes. The index recently hit extreme fear levels, which historically bodes well for future stock market returns.

Remember, as investors, it is often more profitable if you turn your emotions upside/down. Our positive outlook is anchored by the fact that favorable stock market returns often follow extreme “fear” levels, such as we have experienced lately. Simply put, as investor emotions rebound from extreme “fear” levels, the market pendulum tends to swing up—bringing better returns and highly profitable moves.

Summary

After two strong years, the stock market hit a rough patch in the first quarter, with mega-cap growth stocks—including the “Mag-7”—suffering the most with double-digit declines. However, high-quality value stocks, along with your portfolio, advanced amid the turbulence.

Given the uncertainty surrounding the current administration’s tariff and fiscal policy, it is understandable why investors may feel cautious. While market declines are never pleasant, they are a natural part of investing—just like the recoveries that follow. History shows that in the aftermath of market declines, such as in the last quarter, periods of above-average returns are quite common.

Rest assured, we are closely monitoring economic and market conditions and will keep you informed of any changes to our outlook. Thank you for your continued confidence, patience and trust.

Learn how our unique approach and personalized advice can help you grow the value of your financial portfolio.

*Performance data reflects the median return of Pring Turner portfolios, net of advisory fees and transaction costs, for the period January 1 through March 31, 2025. Individual portfolio performance may vary depending on investment objectives, timing of contributions/withdrawals, and other factors. The S&P 500 Index is an unmanaged index and cannot be invested in directly; it does not reflect fees or expenses. Comparisons to the S&P 500 are for general information only and are not intended to represent a direct benchmark. Past performance is not indicative of future results. All investments carry risk. Forward-looking statements represent our current views and are subject to change based on market or economic conditions.