The summer rally arrived in full force. The stock market did ‘climb a wall of worry’ this quarter in spite of the slowing U.S. and European economies and contrary to investor concerns and expectations. In last quarter’s newsletter we stated our goal was to position your portfolio to take advantage of an anticipated up move. You participated nicely in this latest market upswing with healthy portfolio gains.

However, the rally has moved too far, too fast. Investor sentiment, following the stock market gains has become excessively optimistic. We measure investor psychology closely and current readings advise us to expect a pullback or sideways drift for stocks. Current tactics focus on protecting your profits and income. The markets will continue to move in fits and starts, just as the business cycle continues to cautiously move ahead but on an uneven path. We do not yet see the end of this 43 month-old cyclical bull market, but only a temporary breather before heading higher still.

One very interesting observation from our tactical decision viewpoint is commodity prices are rising and getting stronger. Commodity prices, climbing above their 12 month moving average triggered a preliminary buy signal from one of our proprietary inflation models. Even though it is unusual to experience higher inflation and commodity prices during a cyclical global economic slowdown, we maintain the world is in a secular (long-term) bull market for commodities and most surprises will therefore be for higher prices. This secular trend of inflation is covered in depth in chapter 4 entitled, “Inflation, Inflation, Inflation!” of our new book Investing in the Second Lost Decade. The question in our minds: Is this a temporary blip or is this the beginning of a more sustainable upswing in commodity prices? The answer to this question is significant in how we allocate your portfolio in the period ahead.

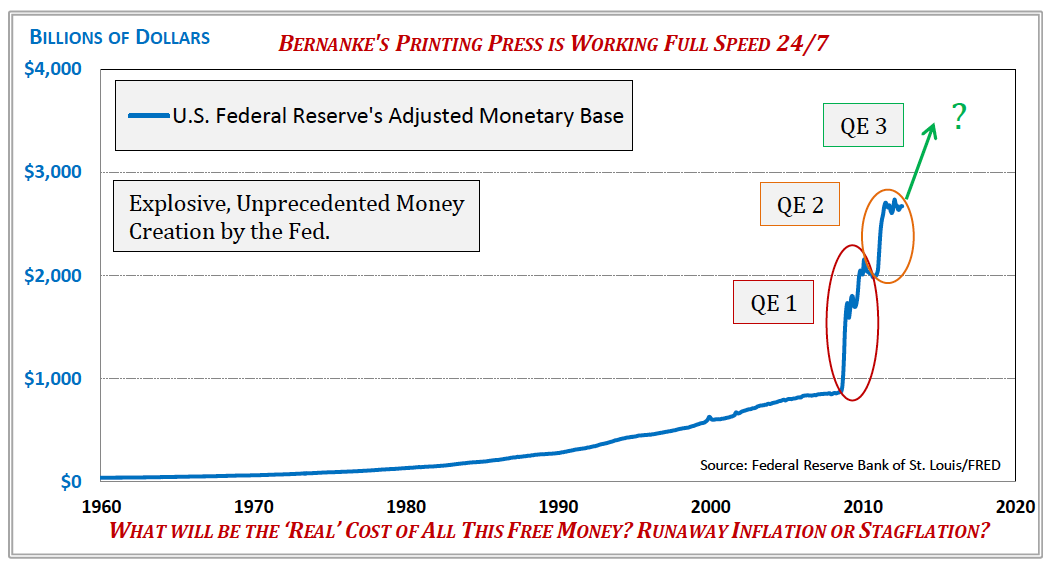

Printing Money and Unintended Consequences

Commodity strength could be reacting to the concentrated global tidal wave of central banks’ money printing process. One controversial tool central banks are using is called “Quantitative Easing” (QE). An important fact is whenever you hear the term “quantitative easing” purchase programs; keep in mind there is no deep pool of savings our Federal Reserve or other central banks can draw from to make these purchases. Rather all “quantitative easing” programs are undertaken by simply printing dollars to purchase assets central banks are attempting to support. Our Federal Reserve has fulfilled prior QE1 & QE2 purchases by creating $1.8+ trillion of new dollars out of thin air since 2009. The new QE3 announced last month promises to create another $40 billion (or $40,000,000,000) new freshly printed dollar bills each month indefinitely or until monetary authorities see ‘sufficient’ economic growth.

Federal Reserve chief Dr. Ben Bernanke in a 2002 speech made reference to ‘a helicopter drop’ of money into the U.S. economy to fight economic slowdowns, hence his nickname ‘Helicopter Ben.’ He stated, “The U.S. Government has a technology, called a printing press (or today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at no cost.” Pring Turner takes exception to Bernanke’s comment “… at no cost.” No country can print endless dollar bills without a significant cost… we just do not know exactly what it is or when those costs and unintended consequences will strike. There will be consequences! One possibility is the return of 1970’s type ‘stagflation,’ a combination of slow or no economic growth coupled with very high inflation. Martin Pring recently wrote a timely article on this very problem, “Green Shoots Being Spotted from Bernanke’s Helicopter” which poses the inflationary potential as a result of the Fed’s QE actions and its consequences.

Investment Implications

Stagflation would be an investment game-changer since it is a scenario not yet experienced by most of today’s investors. Pring Turner has a game plan to address new risks and opportunities that will surface. We are following commodity price movements and developments very closely and will adhere to the disciplines signaled from our business cycle and other forecasting models to guide portfolio decisions. Our proprietary Barometers and other decision-making tools are battle hardened and have stood the test of time. As the business cycle changes, so will we change and adjust your portfolio to best reflect business and market conditions. Pring Turner’s disciplined decision making process is a crucial factor in your superior risk-adjusted performance during this difficult nearly 13-year secular bear market for stocks. Our goal is to generate even better results for you in the years ahead, no matter what the environment, including potential inflation, stagflation, or any other challenges investors may encounter.

We know Pring Turner holds a unique position of trust and responsibility in the financial lives of you and your families to protect your hard earned assets and standard of living. As we enter the last quarter of the year and now in the 13th year of this challenging secular bear market, we are very thankful we have brought our clients safely through these difficult markets. Thank you so much for your trust and confidence in our firm.

Special Announcements!

Martin Pring was in London this July to present our market outlook to more than 100 professional attendees for the Society of Technical Analysts—United Kingdom. The Society then honored Martin by making him a Fellow of the Society in recognition of his achievements and contributions in the field of technical analysis. Congratulations Martin for another lifetime achievement award recognizing your career-long educational and research contributions. In 2000, Martin earned the Canadian Society of Technical Analysts’ A.J. Frost Memorial Award for his outstanding contributions to the industry and in 2004 the Market Technicians Association in New York also presented Martin with their Lifetime Achievement Award. Cheers Martin!

Additional congratulations are also in order for associate portfolio manager Jim Kopas. Jim successfully passed the third and final CFA (Level III) exam this summer. Over the last several years Jim devoted a substantial amount of time and effort to successfully complete the series of three rigorous tests. The CFA (Chartered Financial Analyst) program is the gold standard for investment practice, and demonstrates the best and most respected professional training in the field. The CFA Charter demands a high level of analytical expertise and a commitment to the highest ethical standards above all other credentials in our industry. Well done Jim!

Pring Turner Calendar

Our speaking engagement calendar is filling up fast as Pring Turner continues to receive invitations to present our distinctive investment methodology to various investment and retirement groups. In early October Martin spoke in front of technical security analyst associations in Geneva and Budapest. He also provided television interviews with CNBC Europe and Bloomberg. The AAII (American Association of Individual Investors) has invited Pring Turner to share our investment outlook to several of their chapters over the next two months. First up is the Phoenix chapter on November 10, San Francisco (Berkeley venue) on November 17, and Santa Barbara on December 6. In January, Pring Turner will once again address the San Francisco Technical Securities Analyst Association. We always look forward to sharing our unique business cycle research with others. We welcome invitations to speak to professional and individual investor groups.

DISCLOSURES: Pring Turner Capital Group (“Advisor”) is an investment adviser registered with the U.S. Securities and Exchange Commission. The views expressed herein represent the opinions of Advisor, are provided for informational purposes only and are not intended as investment advice or to predict or depict the performance of any investment. These views are presented as of the date hereof and are subject to change based on subsequent developments. In addition, this document contains certain forward-looking statements which involve risks and uncertainties. Actual results and conditions may differ from the opinions expressed herein. All external data, including the information used to develop the opinions herein, was gathered from sources we consider reliable and believe to be accurate; however, no independent verification has been made and accuracy is not guaranteed. Neither Advisor, nor any person connected with it, accepts any liability arising from the use of this information. Recipients of the information contained herein should exercise due care and caution prior to making any decision or acting or omitting to act on the basis of the information contained herein. ©2014 Pring Turner Capital Group. All rights reserved.