Oct 26, 2022 | Newsletters

This year continues to be one of the worst years for stocks and bonds combined. After kicking off the quarter with a vigorous rally, stock prices reversed direction and finished near the market low for 2022. At this stage of the current business cycle, the same...

Jul 26, 2022 | Martin Pring's Technical Corner

Growing Evidence the Secular Trend in Stock Prices May be Reversing While it is true in the very long run stocks go up, it is also true that secular bear markets are a fact of life. These dangerous extended periods where inflation adjusted stocks underperform can last...

Mar 21, 2022 | Martin Pring's Technical Corner

In October 2021, we made the case for a new secular commodity bull market and concluded that this environment would likely spill back into the economy and stock market. That process is already underway, as the NASDAQ Composite was recently down 20% from its high,...

Oct 18, 2021 | Martin Pring's Technical Corner

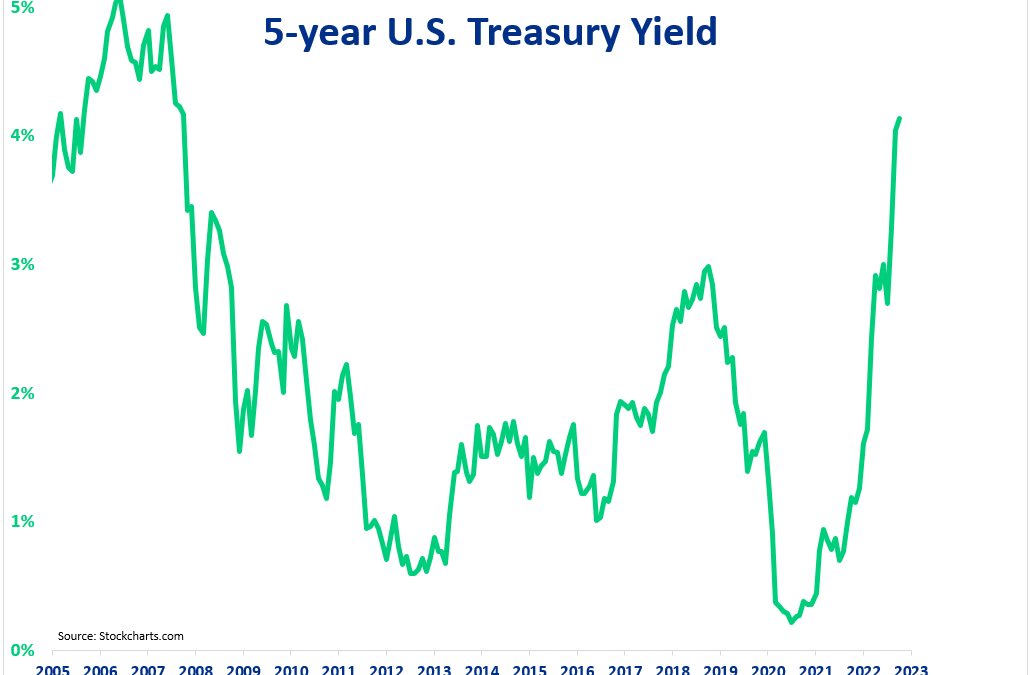

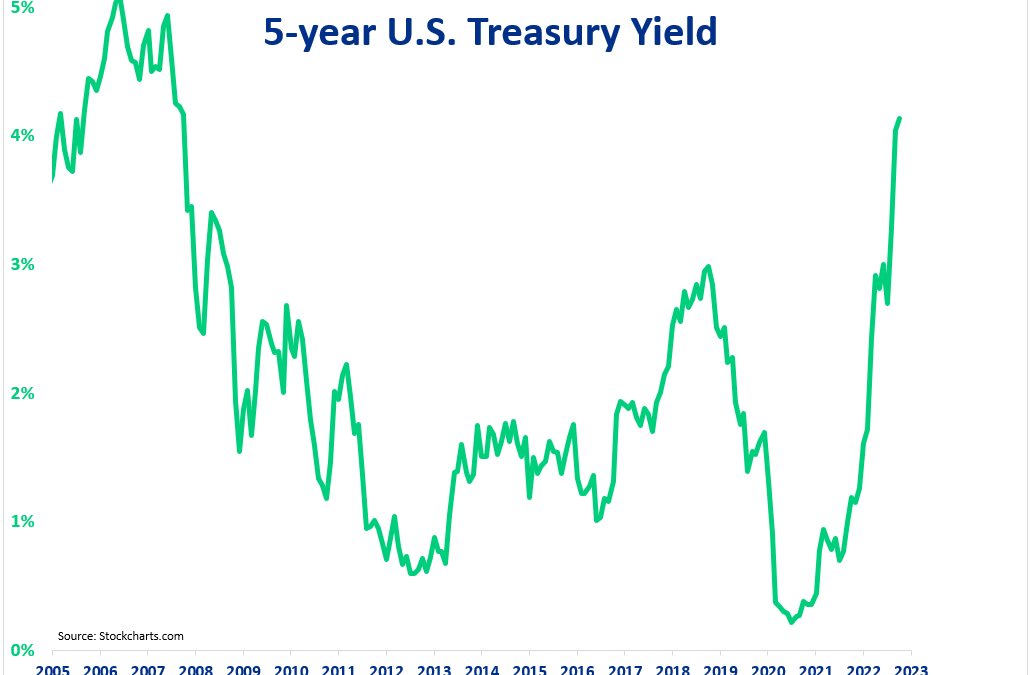

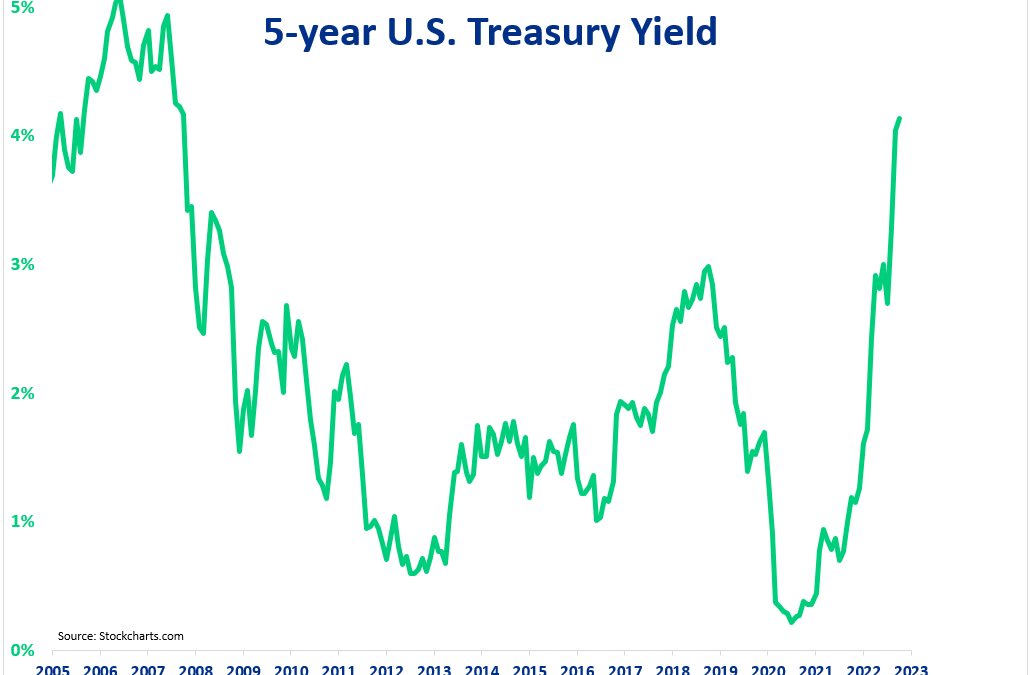

Aging demographics, technological innovation and an ever -expanding debt overhang are three reasons why inflation has been largely kept under wraps in the last three decades. They are still relevant, so why not extrapolate a benign inflation trend into the future? One...

Dec 8, 2020 | Martin Pring's Technical Corner

A year ago, as the economy was emerging from its third slowdown following the financial crisis, commodity prices looked set to move higher. However, due to the pandemic lockdown, the global economy abruptly fell into recession and commodity prices quickly collapsed....