High Quality = Better Returns + Less Risk and Financial Peace of Mind

What would you do if I handed you a map to the Holy Grail of investing? Would you toss it in the trash because Nobel Laureate economists say it’s impossible to beat the market with less risk? Or would you give it a thorough read to see if there is any validity? Let’s find out.

So, how exactly can you earn better investment returns with less risk? In a word: Quality. Yes, it’s that simple. By focusing your investments in high quality (wonderful) businesses you can earn better returns with less risk.

What is a High Quality (Wonderful) Business?

Companies that consistently grow their earnings regardless of the underlying business atmosphere are “High Quality.” These wonderful companies tend to be the cream of the crop in their industry, with key competitive advantages that allow them to continually prosper over the long run. These businesses come in all shapes and sizes, although they typically exhibit three key characteristics.

1) Maintain outstanding financial strength.

2) Possess a unique business model.

3) Are run by top notch people.

As you can see, these are both quantitative and qualitative characteristics that high quality companies possess, making it difficult to judge quality. Just as beauty is in the eye of the beholder, Quality is in the eye of the astute investor.

Fortunately the financial service firm Standard and Poor’s (S&P) has published quality rankings over many years. This provides a simple method for measuring quality. These rankings are based on the company’s most recent 10 years of earnings and dividend data and range from A+ (highest) through D (Lowest). The better the growth and stability of earnings and dividends, the higher the ranking.

“It’s Far Better To Buy A Wonderful Company At A Fair Price Than A Fair Company At A Wonderful Price.” – Berkshire Hathaway 1989 Annual Report

High Quality = Better Returns

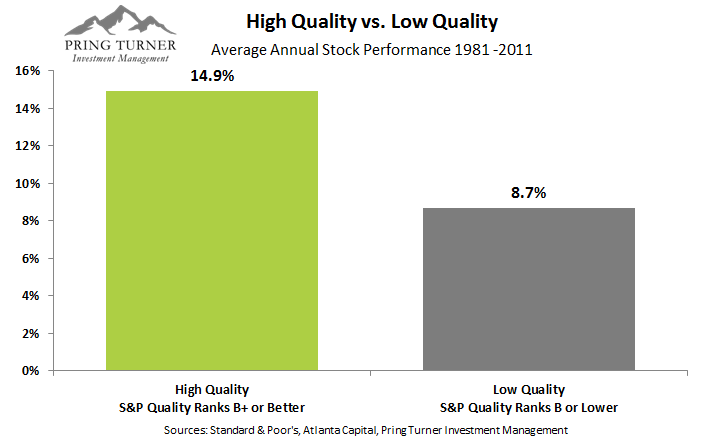

So why does one of the greatest investors of all time focus on buying wonderful companies at a fair price? The major reason is high quality stocks generate better returns over the long run. In a long term S&P study, over the 30 year time span between 1981-2011, High Quality Stocks (S&P Ranks B+ or Better) earned average annual returns of 14.9% significantly outperforming its Low Quality counterparts (B or lower) at 8.7%.

Why Do High Quality Stocks Outperform in the Long Run?

It’s easy to forget that buying stocks is actually becoming an owner in a company (you get much more than a volatile ticker symbol). Over the long run your investment’s performance will ultimately be determined by the company’s business results. Since high quality businesses by definition are those with steady and superior earnings growth, it makes perfect sense that their stocks generate superior returns in the long run over their low quality counterparts.

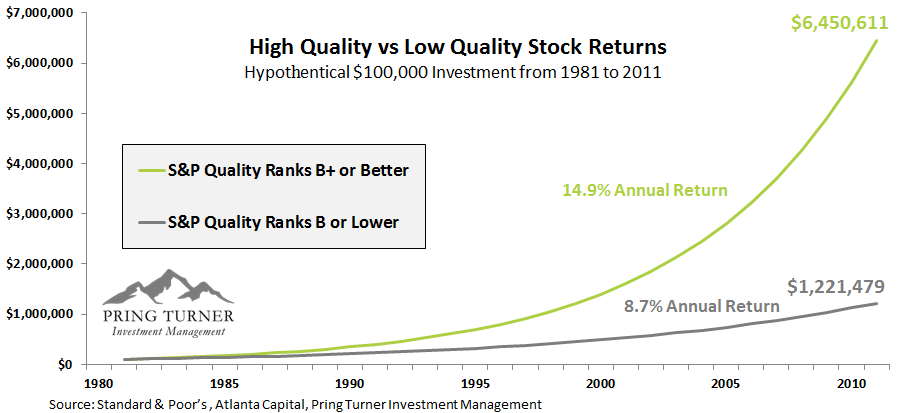

To put the High Quality vs. Low Quality results from S&P’s study in dollar terms, if you invested $100,000 in low quality stocks in 1981 it would have grown to just over $1.2 million by 2011. That is nothing to sneeze at. However by comparison, a $100,000 investment in high quality stocks would have grown to $6.4 million – over 5 times the low quality amount! That is a remarkable $5.2 million dollar difference over 30 years.

Given the superior performance of high quality investments that we just discussed, you might find it fascinating that they actually are less risky to boot. Who said you can’t have your investment cake and eat it too! For more information about the advantages of high quality investing read,The Holy Grail Investment Formula – Part 2, where I will demonstrate the additional layer of protection high quality investments can provide allowing you to better enjoy a safe financial journey with added peace of mind.