IT’S BACK…..!

He sat down on the edge of his chair. His voice quavered and eyes moistened as he began talking. “Mister Turner, I thought I had it all planned out so very well. Even though I took an early retirement, I figured I had more than enough money to provide me with a comfortable retirement. I researched a lot of material and looked forward to doing all the important things in my retirement years. But instead, now it’s all gone, and I am really scared I don’t have enough money to last. Can you help me, I just don’t know what to do.”

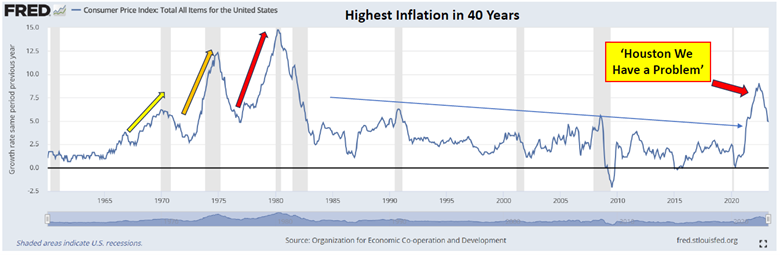

This incident occurred in 1981. Unfortunately, it was not an isolated happening for retirees. The problem was… inflation! Millions of retirees and those close to retirement were ill prepared for the waves of rising inflation that swept through the economy during the 1970s. This retiree was indeed not alone.

My great concern is that after 40 years of a quiet and stable inflation backdrop, a return to the 1970s with multiple waves of inflation would wreak havoc on unsuspecting investors who are retired, retiring, or planning for their retirement. Watch out for inflation…it is back!

Why Is Inflation Important to Me?

Inflation is generally described as rising price levels and is reported each month by government and private organizations. In simplest terms – inflation is better described as the loss of your purchasing power. Some describe inflation as a silent tax on wealth. However, I believe the best description of inflation is that it is a downgrade to your personal standard of living. So, when you hear that inflation is this or inflation is that, you could reframe that word to meaning ‘I am moving toward a permanent lower lifestyle’. Rising inflation means that I am suffering a loss.

So, my new client experienced unexpected waves of inflation over the previous years. In fact, he suffered a lower standard of living that averaged 8% each year for the prior 10-year period: Wow! For an entire decade, every year he experienced a significantly lower and lower standard of living. A key to understanding his pain is that this decline was cumulative.

To illustrate the point, the current inflation rate is 3.7% for the past year (October 2023). But looking at the past 3 years, inflation has climbed (your living standard declined) nearly 20% cumulatively. This means your hard-earned dollar will buy 20% less goods or services than it did just 36 months ago, and you are unlikely to ever get that 20% loss of purchasing power returned. All things equal, which they rarely are, a retiree’s personal living standard has permanently declined by one-fifth in just the past 36 months. What level of loss may occur in the next 3, 5, or 10 years? Those of you nearing or planning your future retirement are well advised to insert higher inflation levels than the past few decades into future financial planning. Caveat Emptor!

Inflation Also Affects Financial Assets Big Time!

Not only does inflation affect your lifestyle, it also drastically impacts the investment world. The level and direction of interest rates are closely attuned and mirrored by inflation’s path. Basically, a bond investor wants a return on their lending that compensates for time, default risk and a return above the rate of inflation. Higher interest rates compete with stocks as investors’ dollars seek the safest and best risk-adjusted returns. Higher inflation brings higher interest rates and greater competition for stock investment dollars. Stocks must provide greater income and better value (or lower prices) to attract investors. Inflation also affects corporate profits as inventory accounting can distort profits. Investors now must sift through ‘real’ versus ‘nominal’ numbers as they evaluate where to invest in a higher inflationary world.

On top of these other inflationary influences, an investor must contend with the government’s actions on the inflation levels. When inflation grows too high and becomes disruptive to the economy, the Federal Reserve monetary officials will step in with heavy braking actions designed to slow the economy, consumers, and business activities. These same Fed actions are also quite hostile to business profits and stock market returns. So, Fed policy becomes another critical consideration during an inflation upswing, adding to investors’ concerns and influencing various asset price behavior.

What Can I Do About Inflation?

You invest differently in an inflationary environment than that experienced with low and stable inflation of the past 40 years. It is time for us to dust off our 1970’s era investor playbook. One crucial determinant to building and preserving wealth in a new inflationary world is to adopt a more proactive plan of action. Even in this difficult uphill overall negative atmosphere for stocks and bonds there will be rewarding opportunities—these are the cyclical upturns that may last two or three years. And those will be followed by cyclical declines where proactive, risk-management techniques can be employed to protect portfolio values and preserve the hard-earned gains of the prior advance. Portfolio management that concentrates on being more proactive with focus on risk management skills can better serve an investor to successfully navigate a new inflation era.

It is our intention to keep investors informed, educated, and up to date to better understand inflation along with investment risks and opportunities. We look forward to our goal to help you protect and grow your valuable assets in this playground of uncertainty.

Joe Turner

Founder, Emeritus Market Strategist

Joe Turner, a finance professional since 1968, transitioned from Dean Witter to form a fee-only SEC-registered advisory firm in 1977, driven by a commitment to client service. In 1988, he co-founded Pring Turner with Martin Pring. A proponent of learning through teaching, Joe has shared financial planning insights in graduate-level courses at Golden Gate University. A graduate of Oregon State University, Joe finds joy in hunting, hiking, and family time with his grandchildren.

Disclaimer

Joe Turner, a co-founder of Pring Turner, is no longer an owner or full-time employee of the company. The perspectives conveyed in this article solely represent the author’s views and do not necessarily align with the stance or opinions of Pring Turner Capital Group or its affiliated entities.

Pring Turner is a Financial Advisor headquartered in Walnut Creek CA, and is registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. All information is obtained from sources believed to be accurate and reliable. This information should not be considered a solicitation or offer to provide any service in any jurisdiction where it would be unlawful to do so. All indices are unmanaged and are not available for direct investment. Past performance does not guarantee future results.