The stock market maintained its dynamic upward momentum this past quarter, and so did your portfolio. Stock prices continued to power higher, despite concerns over ongoing global conflicts, annoying election-year rhetoric, and uneven economic growth. This resilience is often a hallmark of a strong bull market—its ability to shake off negative headlines and keep moving forward. So then, can the market continue to look past the negatives and reward investors? The short answer: Yes! In our view, this bull market still has plenty of fuel to rise even higher.

In over 47 years of managing clients valuable assets, we’ve often found that ‘expert’ opinions, conventional wisdom, and forecasts can be unreliable. Long ago, we replaced idle speculation with well-reasoned, thoroughly researched models to guide disciplined decision-making. Regardless of the latest headlines that may stir investor emotions, you can be confident that our investment process is built on three essential layers of methodical risk management.

An Investment Process Designed to Protect and Grow Your Wealth

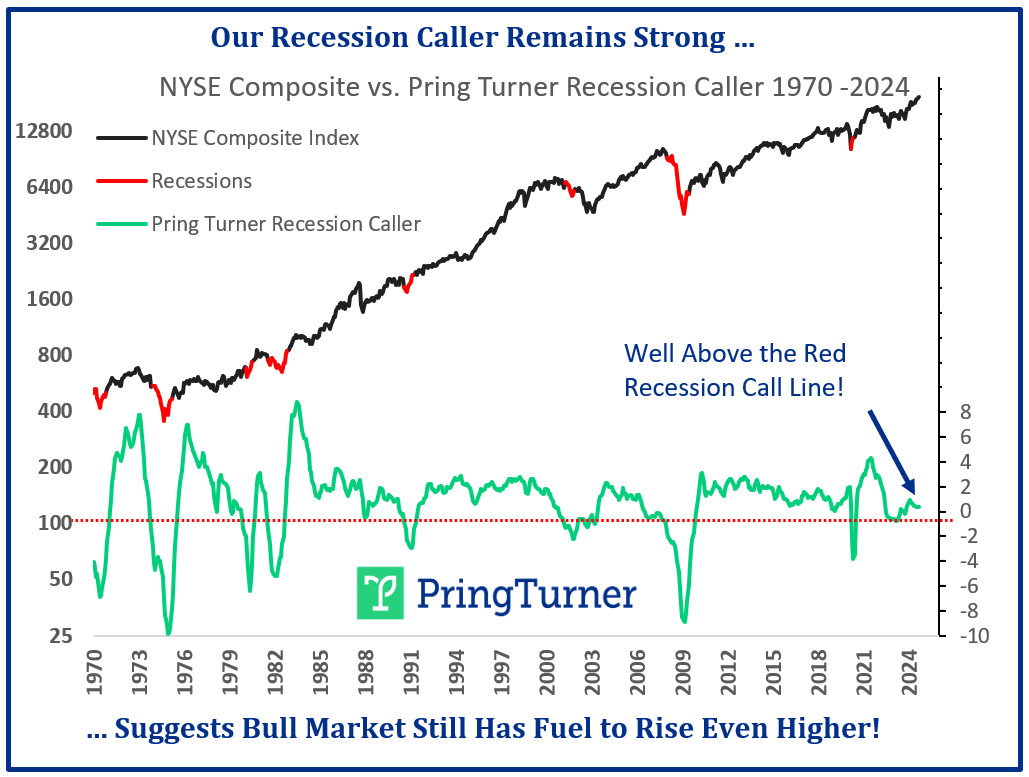

Monitoring Business Cycle Trends: The first layer of protection involves closely tracking business cycle data, as history shows that most major market declines (-20% or more) occur during recessions. Our Recession Caller continues to signal a low risk of recession in the near future, suggesting there is room for stock prices to rise.

Advanced Investment Barometer™: The next level of protection comes from one of our primary risk management tools, the Advanced Investment Barometer™ (featured in our last newsletter). This proprietary tool, containing dozens of indicators, helps us assess the overall risk vs. reward dynamics in the stock market. The goal is to effectively protect your wealth through challenging periods and grow it during favorable times. Currently, the AIB™ model continues to show a maximum positive reading of 100%, reinforcing the strong potential for further stock market gains.

Identifying Quality Investments: The third layer of risk management involves a disciplined, fundamentals-based process for identifying stocks with three key investment traits: Quality, Value, and Income (QVI). QVI is a cornerstone of our investment philosophy, aimed at delivering better long-term returns with reduced risk for you

The combination of both a top-down approach (business cycle and market trend analysis) and a bottom-up approach (QVI—fundamental analysis) is designed to help smooth out your investment journey. Stock market corrections and the occasional painful bear market are inevitable in the financial world. Achieving successful investment outcomes and a secure retirement depends on having a disciplined, proactive strategy that helps navigate major declines and capitalize on favorable market periods. Over our 47-year history, this proactive investment strategy has been the foundation of our portfolio management, resulting in consistent, risk-adjusted performance for you.

Federal Reserve Cuts Interest Rates

At their September meeting, the Federal Reserve announced a half-percent cut to interest rates. This long-awaited shift in monetary policy marks the start of a new easing cycle. According to Chairman Powell, the battle against the high inflation of recent years is nearly won, and the switch to a less restrictive monetary policy is now focused on preventing a potential economic downturn.

The immediate market reaction was mostly positive, with stock prices surging along with inflation-sensitive assets like gold and oil. Interestingly, bond prices retreated after staging a strong rally over the past year, suggesting the bond market had already priced in the Fed’s move. Overall, your portfolio is benefiting nicely from the stock market’s broad move higher this year.

For now, it appears Chairman Powell can take credit for orchestrating an economic “soft landing”—reducing inflation without triggering a recession. However, more challenges undoubtedly lie ahead. One of our concerns is that the recent progress against inflation may prove transitory. Always on alert, we will continue to closely monitor business cycle data for any signs of change.

Election Concerns

Concern about the upcoming election is the most common question we’ve received from clients recently. This campaign has been particularly contentious, with negativity on both sides, which can be discouraging for investors. Election years often heighten uncertainty about the country’s direction. While the election season may cause some additional short-term market volatility, the longer-term direction of the economy is what truly matters. Our observation is that the economy tends to have more influence on elections than the other way around.

Furthermore, any president will likely have to work with a split Congress to enact policy changes and allocate fiscal spending—a process that has historically been slow and difficult. Indeed, Wall Street tends to celebrate political gridlock. Therefore, we don’t expect the election of either presidential candidate to have an immediate impact on the economy. The good news is that, historically, stock prices tend to perform well in the period following election day as uncertainty eases.

Summary

All things considered, we remain confident that this durable bull market can continue to push forward and build on your profits through year-end. Your portfolio is built with multiple layers of risk protection, including core investments offering the added safety of high quality, strong values, and higher dividend income. These layers of discipline provide confidence that your portfolio is carefully positioned for continued stable growth. Additionally, our proactive strategy is designed to adapt to potential market hazards and changing conditions to keep you well-protected.

As we reflect on our client family relationships—some newly formed and others spanning decades—it is truly rewarding knowing that we’ve contributed to your financial peace of mind, which is our greatest reward. Thank you once again for the opportunity to support you on your financial journey. We appreciate and enjoy working with each of you!