Temporary stock market declines are a normal fact of life for investors. Over the past eight decades, the S&P 500 index has averaged over 3 declines of 5% or more every year and at least one decline of 10% or greater. Typically, periodic shorter term declines within a cyclic bull market allow the stock market time to catch its breath, reorganize and reenergize before the primary trend can ultimately take stock prices to new highs. As stated in our April newsletter we anticipated a temporary market correction and prepared portfolios by taking a more defensive stance. Taking a more defensive stance simply means to take some profits, raise cash levels, and partially hedge portfolios with inverse ETF’s. Other protective steps included adding bonds and precious metals companies which typically have appreciated in value as the overall stock market stumbles.

The reality is this past quarter we got it wrong. Looking back, we had the right forecast of expected market turbulence but our tactics did not work out as planned. Instead of helping to dampen portfolio volatility, this time bonds and the metals stocks (the typical “safe-havens”) actually led the way with sharp declines.

What’s next? The correction that began in May is likely only partially over. We suspect over the next few weeks there will be additional zigzagging as market leadership shifts take place. This presents the first real opportunity since late last year to add new investment themes to portfolios on any market weakness. Having earlier taken pro-active defensive steps in portfolios we are now in a position to observe and take advantage of any leadership changes. The business cycle is progressing in a normal fashion and we expect to see a visible shift to favored sectors that usually take place later in this business cycle expansion. At Pring Turner we define this financial environment as Stage 4 of a six stage business cycle which is characterized by leadership coming from energy, materials, and industrial sectors of the stock market.

Our job is to continually survey the investment landscape and look for opportunities to create attractive returns with reasonable levels of risk. As always, our focus is searching for superior companies paying good dividend income and showing solid value characteristics. Quality companies with dependable dividend income are hallmarks of Pring Turner’s conservative investment strategy. Over the years and through many ups and downs, this important risk management discipline has allowed us and you to sleep better at night.

Secular and Cyclical Asset Class Update

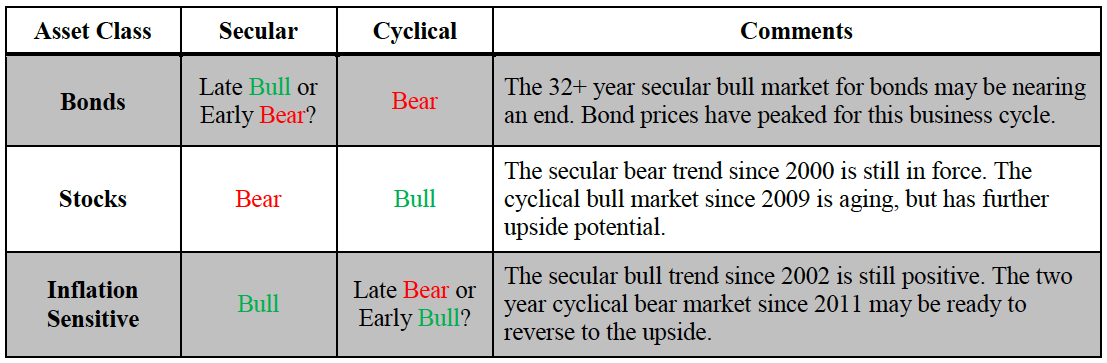

Another risk management control we utilize in portfolios is to pay careful attention to both the Secular (15-25 years) and Cyclical (4-5 years) trend for each major asset class (bonds, stocks, and inflation sensitive securities). Understanding the background environment for each helps us decide what asset allocation is optimal in portfolios while seeking the best balance between both risk and reward. Our book released last year, Investing in the Second Lost Decade, extensively explored this subject for each asset class. Taking into consideration the fact that stocks recently traded at all-time highs, bond market volatility has increased and commodity prices have shown weakness we thought it would be a good idea to review our outlook through these two important timeframes.

First, bonds starting from record high levels of interest rates in 1981 have appreciated in value for the last 32 years, indeed experiencing the greatest secular bull market for bonds in history. But from recent historic low interest rate levels we believe another important secular turning point is nearing, if not already passed. Bonds have been perceived as a “safe-haven” asset all these years, but recent weak price action as interest rates spiked higher is challenging that safe-haven complacency. For portfolios, our tactics have been to limit exposure to the bond market and emphasize shorter term high yield corporates and floating rate securities.

For the stock market, headlines in May of all-time highs are comforting until investors realize prices first approached these levels in the year 2000, now nearly 14 years ago. Fourteen long years going nowhere but with plenty of ups and downs in between. In fact, in inflation adjusted terms, prices would need to appreciate more than 20% from here to set new inflation adjusted all-time highs. We continue to believe the secular bear market for stocks is still in force but the cyclical advance since 2009 will continue higher. Stocks can still do well even with rising interest rates, but only for so long. Typically, business cycles and cyclical bull markets end with much higher interest rates and inflation—so while the cyclical bull is getting long in the tooth there is still more upside potential ahead for common stocks.

Speaking of inflation, commodity prices have been in the news recently but for a different reason. Prices for some are hitting two-year lows and put into question the health of the secular bull market in commodities that began in the early 2000’s. Our view is the long-term strong period for commodity prices is still in force, but a cyclical decline that began in 2011 may be about to change for the better. If this business cycle ends like all others, we would expect to see a strong rally in the commodity markets (including energy and metals). Look for these sectors to take over market leadership as the next stock market advance re-ignites.

Investing is a process best described in probabilities, there is no certainty to the future. Over the years, we have managed portfolios through numerous both good and bad periods. There are times when we can feel pretty smart and other times where the market humbles us and we don’t feel so smart. Nobody has a perfectly clear crystal ball into an always unknown future. Our job as conservative investment managers is to continually weigh the risks vs. reward for each asset class and proactively re-allocate portfolios. With decades of experience and a carefully thought out investment discipline Pring Turner has delivered consistent returns while taking much less risk than the market. We are confidently looking forward to seeing your portfolio at new recovery highs (adjusting for any deposits or withdrawals) as the market rebounds.

Thank you for your confidence and placing with us the important responsibility of protecting and growing your wealth. Please let us know if your circumstances should change or if you should have any questions regarding your portfolio.